Having a family of 5 can get pretty expensive, but over the last three years I have almost halved our outgoings and expenses. How? Well here’s my top 5 tips for saving. I’ve based these tips around family but hopefully anyone can use these money saving tips.

Sit down, grab a cuppa and a pen and paper. Start by writing down all of your income for the month. Then go through everything that leaves your account, rent/mortgage, council tax, internet and phone, media, subscriptions, gas, water and electricity, plus any other bills.

After doing this you will have your budget for the month, now from this budget you need to take off how much you usually spend on food and groceries each month (I will go into more detail about reducing your food bill) as well as travel expenses, and if you can take some off this budget to put into your saving account, even if its £5-£10 (obviously the more the better) it will make you feel good, I promise! Did you know that it’s easier to save if your save your money on the day your paid?

Before I had children I could easily spend upwards of £50 on other media and subscriptions each month. I have cut these right down now and all I have is Netflix and Amazon Prime, because what parent can’t live without prime?!

Now, with reducing your subscriptions you can do one of two things. You can either add this back into your budget, or you can put it straight into the savings pot, which is what I do every month, this really helps boost your savings and it gets addictive watching your little pot grow!

Meal planning is another way I have saved money each month, I plan out my meals for a whole month, as I do one big food shop with all my dry goods, tins, and meats (I freeze all of our meat and get it out the morning I need it). It’s a lose monthly meal plan, but there’s a meal for every day of the month in my cupboards and freezer. I chop and change our meal plan around especially if I’ve had one hell of a day with my three munchkins and I don’t fancy making something from scratch, I grab something out of the freezer.

One pot meals are great as you can make a lot! If I make, say a chilli, I make double and freeze, so next time we have chilli I can just grab this out and heat it up, this also reduces a lot of our food waste.

Always, always make a food list and stick to it this is my biggest tip. So many times I would walk into the supermarket and come away with things I didn’t need and would often forget things on my list. I do one large online food shop each month, instead of actually going to the supermarket, as your not drawn in by those offers, that honestly make you spend more money than you save.

Look through your cupboards, fridge and freezer, make a list of what you already have in there, so you don’t end up worrying if you already have it or not. This will stop you from buying double and potentially wasting food.

Then for the weekly fresh stuff, I go to the market or local shop and get the weekly essentials like, bread, milk and fruit. I find fruit and veg is usually cheaper off the market and you get more! I have a budget for £10 per week for the fresh stuff, I often buy reduced label essentials, you can freeze most fruits and veg, if they are on their use by date (which is usually the case if you buy reduced) , you can freeze them for up to 3 months, then get them out the day before you need them!

Shop around, some weeks you will find that your usual supermarket is more expensive than one you haven’t used in a while. Also if you have young children, keep an eye on who has their baby and toddler event on, because you will be able to pick up, snacks, nappies, toddler toiletries and wipes cheaper! Most supermarkets also have other events on like deals on fruit and veg, and cleaning events!

I also buy supermarket own brand, this has been a trial and error process, some of it is as good as the big branded stuff, some of it is even better, and some of it is just down right nasty and not worth it!

Takeaways and eating out, sure its a nice treat, but its expensive. I guess this will depend on your budget and how much you want to, or need to save. We have stopped having takeaways all together. Instead we make our own takeaway style dinner once or twice a month. We save eating out for special occasions, so for birthdays, or anniversaries.

Its a well known fact that large household appliances use a lot of power, even the most economical machines still use a lot of electricity if you have them on constantly. We don’t have a dishwasher so that’s one way we are saving money. How do I stay on top of the washing up with three Munchkins? I hear you ask, I wash up as I go along through out the day so there’s not a massive pile of dishes to do come bedtime!

With using the washing machine and tumble dryer, I have a set day for doing all of the washing and most of this will be done late in the evening when electricity prices are cheaper. The tumble dryer, the bane of my life, it such an energy drain, so I don’t use this through the spring, summer or autumn months, I hang my clothes out to dry on the line, if its raining I hang it up inside and open the windows.

A smart meter can help you see how you are using your energy and how much it is costing you. Turning off appliances instead of leaving them on standby helps a lot!

I was so surprised at the savings I have made by switching to reusable items.

So, this is something I have started doing over the last year, it started with reusable baby wipes, I bought some baby wash cloths, two Tupperware boxes, 2 large ones for at home and 2 small ones for out and about, I damp the wash cloths, add some essential oil like chamomile or lavender (one box for hands and face, the other box for bits and bums, and one box is used for clean and the other dirty). We have enough cloth wipes to last me the whole week for three messy munchkins, so I still only put my washer on once a week!

This year I have only purchased one box of 12 wet wipe packs this year so I have saved a huge amount considering the ones we buy are £10.50 a box, and I would have needed one and a half boxes to get me through the month. Using the wash cloths has also reduced the amount of times they have got nappy rash, so we have also saved on buying nappy rash creams.

Another way you could save money with your children is by using reusable nappies. The initial investment can be a bit pricey, but remember to shop around and in the long term you will be saving a lot!

I think it is ridiculous how expensive sanitary products are. We have recently switched over from tampons and sanitary pads to a menstrual cup and reusable bamboo pads. I have saved around £20-£40 per month doing this. You wash the pads the same way you would the wash the cloth wipes, I do use a biological powder to wash them in and always give them an extra rinse in the machine, to make sure there is no bio powder left in them, as bio powder can irritate your skin. This is definitely worth looking into and actually I find that using the menstrual cup, I leak less throughout Aunt Flo!

Reusable make up pads are also another great alternative to the disposable versions, and will save to money in the long run.

You could also look into using bamboo tooth brushes, its surprising how many plastic tooth brushes end up in our oceans and are hurting our marine animals.

No matter what your income, or your outgoing, I hope these tips will help you with saving in some way. There are lots more tips out there, but these are just my top 5, aimed at families with young children, and I’m pretty sure there are some I haven’t mentioned here, so if you have other money saving tips feel free to drop them in the comments below!

What are you saving for this year?

Enjoyed the read? Check out the main Need to Live website for more.

Disclosure: this post contains affiliate links. If you click through and take action, I may be compensated.

Comments are closed.

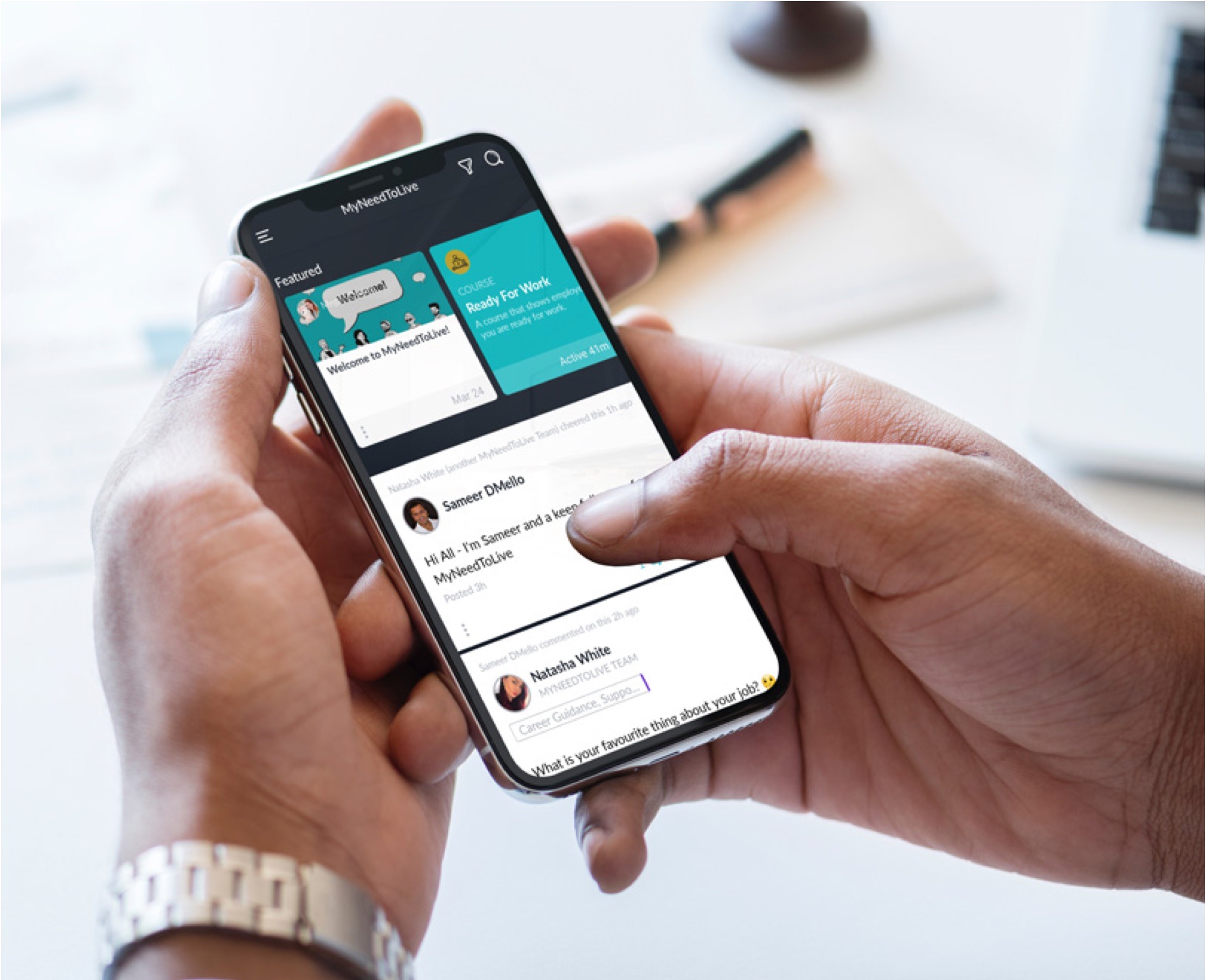

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

I love these tips! We also budget but we do a weekly shop instead of monthly. I really need to have a go at reusable wipes and invest in reusable make up pads and sanitary towels!

These are some great tips! I especially love the one about sitting down and taking the time to work out your budget. It really gives you an idea of what you’re working with throughout the month and where you can cut back. I’m definitely looking at switching to reusable make-up pads in the future – I’ve only heard good things so I’m going to give them a try!