Credit Cards, some of you may be saying YES! I have one or some may say yeah, I have those. Credit Cards can be a great tool to help you build credit or ruin it. As a college student Credit Cards have been around especially for you, although there are stricter rules to obtain them, Credit Card Companies will still give them out like Candy with high interest rates.

I remember my first Credit Card, I was in college, at a time when Credit card companies could basically set up shop at your campus, have you apply right there and boom your approved. The rules have changed a bit and credit card companies are typically not allowed to be on campus trying to score their next sale.

In my case, I got my offer through the mail, Pre-approved for a nice limit of $5,000 with 24.99% interest, but heck I didn’t care, I had a credit card, free money, I could buy things, go shopping, stop living paycheck to paycheck. Yes I was young, 18, never grew up with the best financial education, but I was an adult and working part time, I got this.

Boy was I wrong, slowly but surely, I started small, some lunch, maybe a shirt, the balance creeping up each week, then the bill came with a minimum payment of $25.00, I paid it done. As you can see I did not have the best relationship with managing my finances. I was working part time, making enough to pay for my food, living at home and gas for my car, but hey I had the plastic.

Soon I got in the habit of just paying the minimum payment but that did no good for the balance and in a matter of time I was maxed out with a still reasonable payment but mostly going to interest, I was stuck for years payment off pay balance until I got a real job with real money I was able to finally pay it off, but it was a tough lesson.

This lesson changed the way I tried to manage money, but it always seemed in my life I never had enough money, I had a love for credit cards, buy now pay later. This is not the healthiest way to manage money and your credit. I will say this again Credit Cards are a tool, but a tool that can be useful to pay off in a short time and I don’t recommend students have them until they are older and have a grasp of how they work.

Now you may say to me, well I am responsible, I am taught how to manage my finances by mum and dad, I should be fine. I will say be cautious with that attitude, if you insist on having a credit card for emergencies there are options like what is called a secured credit card, basically that your hard earned cash, where a bank will put a hold on that cash as collateral, in exchange you will get a credit card for the balance of what is on hold, (i.e. 500.00 on hold with a $500 credit limit). This option I highly encourage, because its manageable and you will never go over what you have set aside and the most positive note you will build your credit.

I have learned some hard lessons in life with credit and I continue to this day, I guess for me I have had X amount of money and X amount of bills and never enough money, so its important to live within your means especially as a student.

Credit card companies are in it to make money, that is why students are great customers, they are young, at times naive and prone to make mistakes like what I did, they are counting on it. Be smart wait on the credit card, if you must get a secured and be responsible that way.

Credit Cards do not make you more of an adult or responsible they are a tool that can be used for good or bad and in today’s world they get many in a lot of financial hardships, don’t fall into this trap.

Keep your finances simple, buy what you have in cash, work and live within your means and resist the temptation of opening credit until you are financially ready, I hope this opens you eyes to the dangers.

Comments are closed.

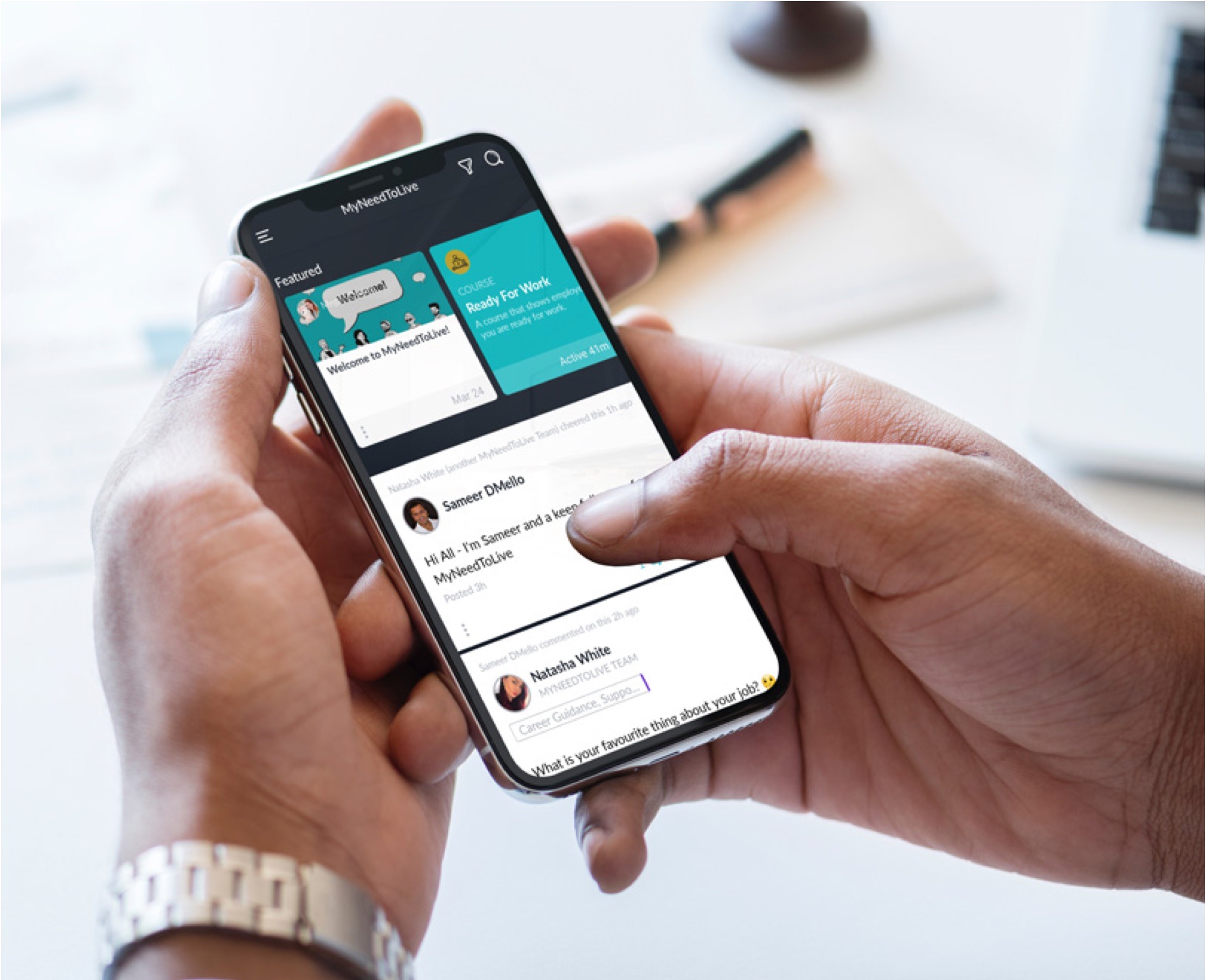

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

I didn’t have a credit card at uni and I’m glad I didn’t – I’d still be paying it off!

Plus I saw the nightmare some of my friends got into, it’s really not worth it until you have a solid and reliable means of repayment. (And I had numerous part-time jobs at uni).

Awesome! I think like many of us have impulse control issues that we want things now. Thank you for reading.

I love this post and one-hundred percent agree! I actually leave my credit cards at home on my days out so that I’m forced to stop and think when I “want” to make a purchase. Rather than just tapping the card on the scanner and thinking “Oh. That was just $10… I’ll pay it back,” I’m forced to think, “Well, I only have this much on hand … is it worth it?”

Again, love this post.

Thank you for your kind words . I’m glad it helped you and your trying to manage your finances responsibly.