Comments are closed.

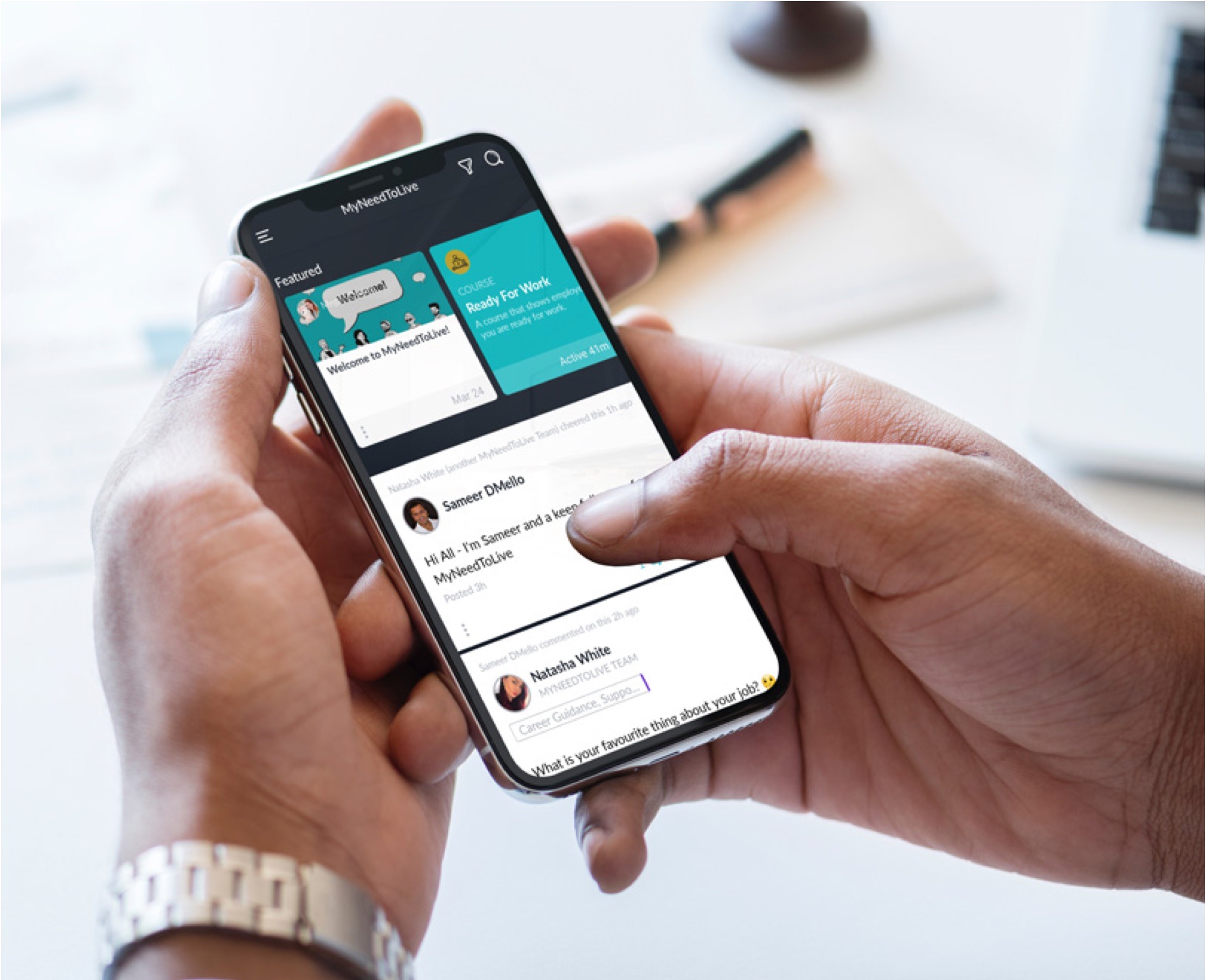

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

Having been someone, who has just had to ‘up’ my credit card payment, I his has been really helpful. I didn’t realise I had my credit card set up on paypal???? so silly expenses were coming out. I removed it from every account (I hadn’t realised my debit card and credit card had similar last four numbers…)

So I have my credit card for desperate things ONLY. I have agreed to pay over the suggested voluntary amounts and even asked if I would be eligible for a lower interest rate, she told me not at the moment but ask again in 3 months time. So thank you for the suggestion. Thank you for the excellent post ????.