Are you living paycheck to paycheck? Do you have little to no money in a savings account? Do you wonder where your money has gone at the end of the month? Do you struggle to pay your routine bills, let alone get your debts paid off? Are you overwhelmed with debt wondering how the heck you will get rid of it?

Or have you accepted that being in debt is simply “a normal part of life?”

Learning how to budget may be perfect for you!

The basis of your budget is subtracting your expenses from your income in order to reach zero each month.

A budget is a guide to tell your money where to go every day, every month, and every year. A budget is a predetermined amount of money you are going to allocate to each expenditure that you have.

There are two types of expenses, fixed expenses and variable expenses.

The fixed expenses are things that don’t change every month. Some examples of these are rent/mortgage, auto loan, cell phone, preschool, etc. The variable expenses are those that vary each month, these would be things like electricity, groceries, entertainment, clothing, gas, etc.

In addition to monthly variable expenses, there are also yearly variable expenses. These can be things like Christmas gifts, birthday parties for children, haircuts, car services/repairs, car registration, etc.

The fixed expenses are the easiest to budget for because you already know what to expect ahead of time.

The variable expenses are usually the culprits in excessive spending each month. The variable expenses can be difficult to not overspend on because they vary based on different things, including your own whims and emotions!

Either write out your budget in a journal/notepad, or create an electronic document to store your budget.

Keep in mind that a budget can change month to month for various reasons.

Once you have about 30 minutes to an hour of uninterrupted time you can start working on your budget. If this is an emotionally overwhelming process for you, you may want to put on relaxing music and make a cup of hot tea (or coffee).

When you feel ready, start by writing down all of your expenses for the month. I would recommend using a notepad versus an online budgeting tool at this point.

For the fixed expenses write out exactly what you owe for the month and the dates that the payments are due.

For variable expenses create categories and write down the amount that you want to spend in each of them for the month. If you are not sure how much you want to spend on variable expenses then look at a) how you spent on the categories over the last 30 days and b) how much money you have left over in your budget once you subtract your income from your fixed expenses.

Understand that it’s okay that you don’t do it perfectly. With time and practice you will get better and better.

The most important thing is to start.

Next, write out your total income for the month. Write down your income from all sources: wage income, side hustle income, child support, alimony, etc.

I go by a 4 week rule to define my “month.” This is how I create my standard budget. Therefore, in order to track your income add up your income over a 4 week period.

Do you get paid every week or biweekly (every other week)? If you get paid different amounts each pay period try to do a rough estimate for the month.

Once you actually get paid then you will need to do a budget for that specific pay period. It is still a good idea to do an estimate ahead of time so you have a rough idea of what to expect.

Now it is important to understand that some months actually have 5 weeks. Twice a year you should be receiving an extra paycheck (usually this is usually somewhere around January and August- it changes to keep that in mind). However, I use a standard 4 week as my guide for my budget.

What happens to those extra 2 checks a year? Well subtract your variable expenses (groceries, gas, entertainment) that you budgeted for those weeks, and whatever is left over can go into either your debt snowball or into your savings account.

The good news is that you only have to worry about a handful of your total bills being under control because the fixed expenses don’t change month to month (they can but it is usually not very often).

The bad news is that the variable expenses can get really out of hand if you do not stay alert and diligent.

I believe in budgeting for personal spending each month so that you have a little bit of freedom and more motivation to stay on track with your variable expenses.

Budget in your fun! (But stick to what you budgeted for!)

My advice is to set a fixed amount that you want to spend each month on your variable expenses and then track your expenses each week to ensure that you are on track.

For example, if you want to spend $40/week on gas, then fill up your tank with the $40 and monitor your usage throughout the week.

I usually start my budget week on Friday because that is payday for me. Each budget week goes from Friday-Thursday. This means that I start calculating my weekly variable budget on Friday up until Thursday, so from Friday to Thursday I have $40 to spend for that week on gas. Let’s say I am too busy on Friday to get gas so I go to Costco on Saturday morning at 8 am (to beat the line) and fill up my tank with $40.

That gas is then supposed to last me until Thursday night. The hard part is to stay on track with my use throughout the week. If a friend who lives 30 minutes away wants to meet up, I might have to turn them down because I need my gas to last until Thursday in order to stay on track with my budget. Gas is overall pretty easy to keep on track because we all typically have a routine we follow throughout the week.

The most challenging parts of a budget are staying on track with the fast food/restaurant spending, entertainment spending, and extra expenses spending.

Does your friend have a birthday party coming up that you didn’t account into your budget? Did your best friend call you at the last minute to go out for dinner and drinks? Are you bored at home and want to catch the latest movie to entertain yourself? Did you find out about a last minute sale on your favorite clothes?

These are the tricky situations that come up which can completely annihilate our budget.

Once you know how much you are spending in these categories you then have the ability to know where you can start cutting back. Maybe you don’t need to spend $200 a month on eating fast food/restaurants.

Conclusion

So to reiterate, first you write down all of your expenditures for the month.

You write out the exact amounts for fixed expenses, and then you write down what you want to spend on variable expenses.

Each week you write down exactly what you are spending on your variable expenses (refer to receipts or a bank statement for the calculations) in order to stay on track and spend what you said you wanted to spend for those items.

You then write down all of your income for the month.

You subtract all of your expenses (fixed & variable) from your total income. If you have extra money you put that right into debt payments.

If you are out of debt then you put that extra money into a savings account.

If you don’t have enough money then you look at where you can cut back on your variable expenses so that you are truly living within your means. (Don’t use credit cards to make up the difference!)

Using a budget, you slowly learn where your money is going each week, month, and year. You give yourself realistic expectations on what you can afford, and also what you are actually spending. Also, it ensures that your necessities are always taken care of, i.e., rent, utilities, cellphone, groceries.

Once you start budgeting you create awareness regarding your life and your spending habits. It’s hard to change something that you are unaware of being an issue.

A budget is a great way to guide your money into the direction you want it to go and help you to accomplish your financial goals.

A budget is great because you learn how much extra money you have each month.

Extra money should first and foremost go into paying off your debt. Paying off debt is important because you are spending extra money each month just in interest to the lender (it could be upwards of hundreds of dollars each month).

Once you have your debt paid off, you can then start putting your extra money into a savings account in order to create an emergency savings cushion.

Emergency savings are important because life is messy (things happen all of the time!). It is important to give yourself a sense of security and a financial cushion.

Honestly creating a budget is the easiest part of the process. The real struggle comes down to keeping yourself on track with your spending each month.

Have you considered a plan to keep yourself accountable? Everyone gets and stays motivated in different ways. Think about a time when you reached a goal, what kept you motivated even when temptation came up and things got hard?

There are a variety of ways to stay accountable:

Please understand that just like weight loss, money management is a lifetime commitment. Unfortunately there are no quick fixes to solve your problems, you have to work at it every day.

Fortunately, every day is a new day and gives us a chance to start fresh. Maybe yesterday you overspent on an item but today you can make a new resolution to stay on track.

We are not going to budget perfectly- we are human beings and not robots! But we can surely create small changes that lead into big results overtime. I hope this article was helpful to your debt free journey.

Please leave a comment below letting us know how you stay on track with your budget! We all want to learn from each other!

Comments are closed.

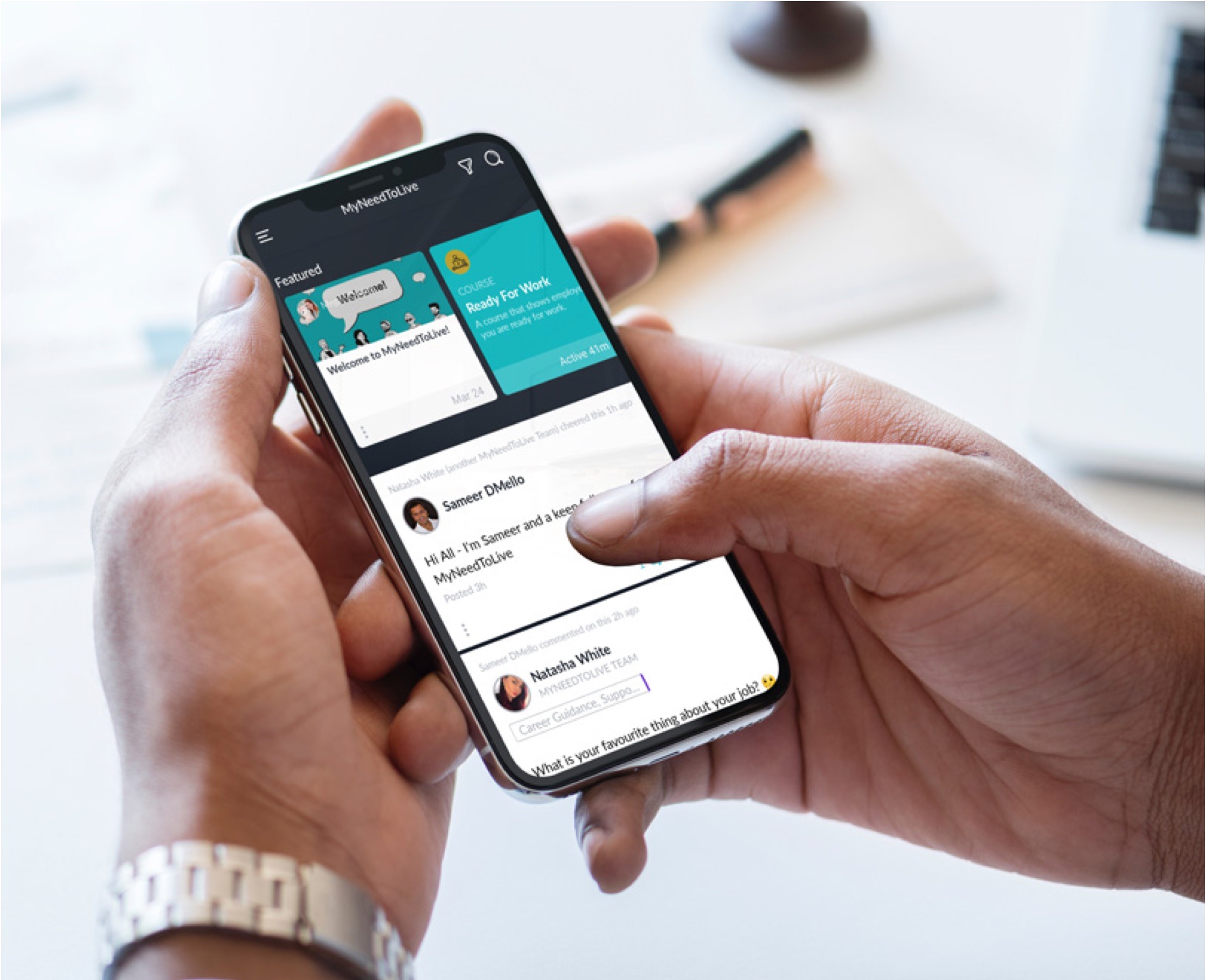

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

Good read! I think budgeting is the foundation of personal finance and it is very important to get it right

I completely agree! A good budget is the foundation of getting your finances in order 🙂