Who doesn’t have wishlists? Some are just tiny simple wishes to have a good taco once in a while, whereas some are those bubbles over our heads while we are day dreaming and thinking about those exotic locations for vacationing. We all dream and we think that one day we will able to earn that much to fulfill them.

Well I say, why not get those dreams into reality? Let’s get started to build your wishlist and that too on a budget!

What are you dreaming about? A vacation, throwing a birthday party, new car, that statement jewellery? The #SavingsJar Technique is here to the rescue. You can achieve anything if you use this technique, religiously. Trust me, I use it all the time. But you need to have a goal (or multiple goals, but let’s start with one). It’s important that you write down your goal, however silly it may seem, but once you write it down, you actually let the Universe know your wishes. It works! It could be anywhere, a sticky note on your laptop, your bullet journal, your phone, anywhere.

Fixing a financial goal seems a bit vague to start with, so it’s always better to start with short-term goals. Say, you want to go on a vacation to a place you like for your birthday and you start checking the details of the tickets, number of days you want to spend there, accomodation, food, etc. and you realise it will cost around £400 for the entire trip. That’s a lot of money to accumulate.

I say, you start saving for that financial goal, each day, each month, by tweaking your daily expenses. If you have two months to go for your dream vacation, you just need to save up around £6 every day and even less if you have around three months!

Now once you know how much you need to save up every month or every week for your dream thing, you start adding up the money. But where do we do that?

You could do something very basic like a piggy bank at home and put cash in there. Some traditional methods include, doing a recurring deposit of the amount periodically and also getting an interest thereon.

Or, you could open up a sinking fund! What’s a sinking fund you ask? It’s a fund that you set-up periodically to set aside money for repaying a debt usually. But you can easily use it the other way around to save up money for something you need to buy.

You can either deposit the money in the sinking fund yourself or create a standing order with your bank to deduct the month depending on the period you want to.

You can practically apply this technique to almost all the money needs –

1. Debt repayments

2. Creating an emergency fund

3. Student loans

4. Your dream vacation

5. Buying that car

Anything.

Once you start saving up, you would get a sense of deep satisfaction and a good feeling of handling your finances. Start with something small like say £50 a month. If you feel that’s too much, it’s time to consider your spending habits. Make a tracker of your daily expenses and see where you’re spending those extra dimes and if you can curb it.

So start today, write down your wishlist or that plan you have been dreaming of, understand what you need to achieve that amount, save everyday, talk to your bank and get those dreams into reality.

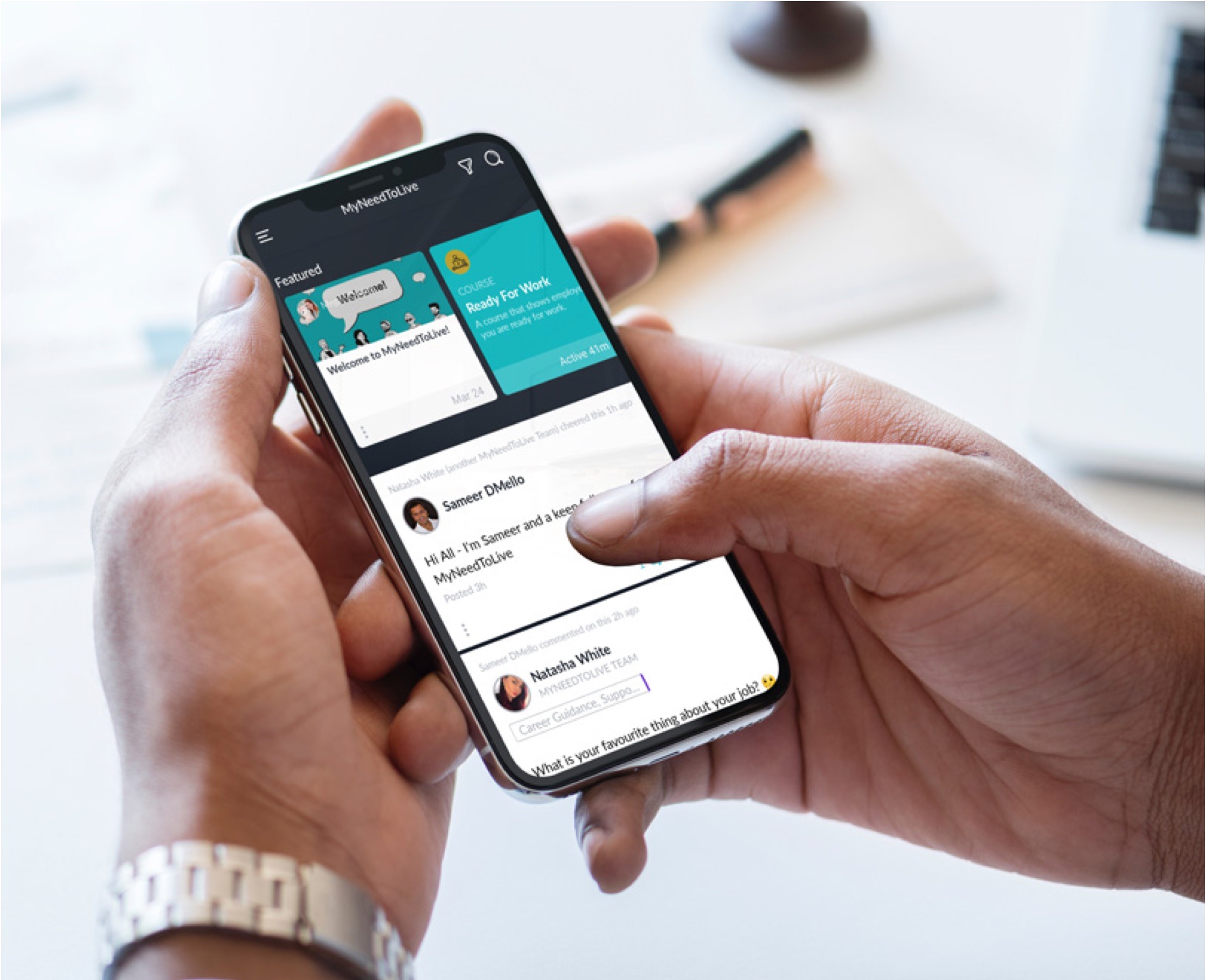

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

Rashmi Kathuria