Do you often find yourself scrolling through the many gorgeous images on Pinterest or Instagram and, perhaps subconsciously, promptly begin fantasizing about winning the lottery? Do you allow yourself to imagine all of the many ways your life would be infinitely better if only you could trade lives with that one social media blogger you follow? If you’re silently nodding your head right now in agreement, it is quite possible that you’ve got a case of what I call “needing to keep up with the Jones’s”.

Most of us are familiar with the concept of constantly trying to keep pace with the social influences in our lives. While this idea is certainly nothing new, the pure prevalence of social media in our lives makes it seemingly impossible at times to avoid feeling inadequate. If this describes you and/or thoughts and feelings you have had, I encourage you to take a deep breath, close your eyes, relax your shoulders, and pause. You got this, lady! It’s time you focused less on the influences beyond your control and instead, focus more on what is within your grasp: your attitude, your sense of gratitude, and your financial health.

First order of business: adjusting your ATTITUDE.

“Most folks are as happy as they make their minds up to be.” – Abe Lincoln

One of the most empowering things you can do in life is to decide to be in charge of your attitude. Only you can control how you respond to a situation, and only you can decide the type of life you’d like to lead. Instead of wishing life had dealt you a different hand of cards, play them to the best of your ability.

Next up: increase your GRATITUDE.

Remembering that each day is a gift is a great way to refocus your priorities on what is actually important. Having trouble stopping to smell the roses and appreciate the seemingly trivial blessings in your life? Set an alarm in your phone for the same time each day to remind yourself to be grateful. Need help, even still? Try writing down one thing you are grateful for before climbing into bed at the close of each day.

Finally: take ownership of your FINANCIAL HEALTH.

Most social media applications only feature photos from folks when they’ve got something positive to share. Remember, no one likes to post when they’re feeling down or are having a particularly tough day. Don’t compare yourself to the highlight reel of glamorous posts on your newsfeed. Instead, take ownership of your financial health so that you, too, can be in a better position in the years to come. A few recommendations:

Author: Brittan Leiser

Brittan Leiser is a Financial Advisor in Cleveland, Ohio. Brittan created AdvisHER after recognizing that in the male dominated financial industry, women often felt ignored or overwhelmed when it came to having a conversation about their own personal finances. A graduate of the University of Notre Dame’s Mendoza College of Business, Brittan is passionate about helping clients understand their financial options in order to achieve their true potential.

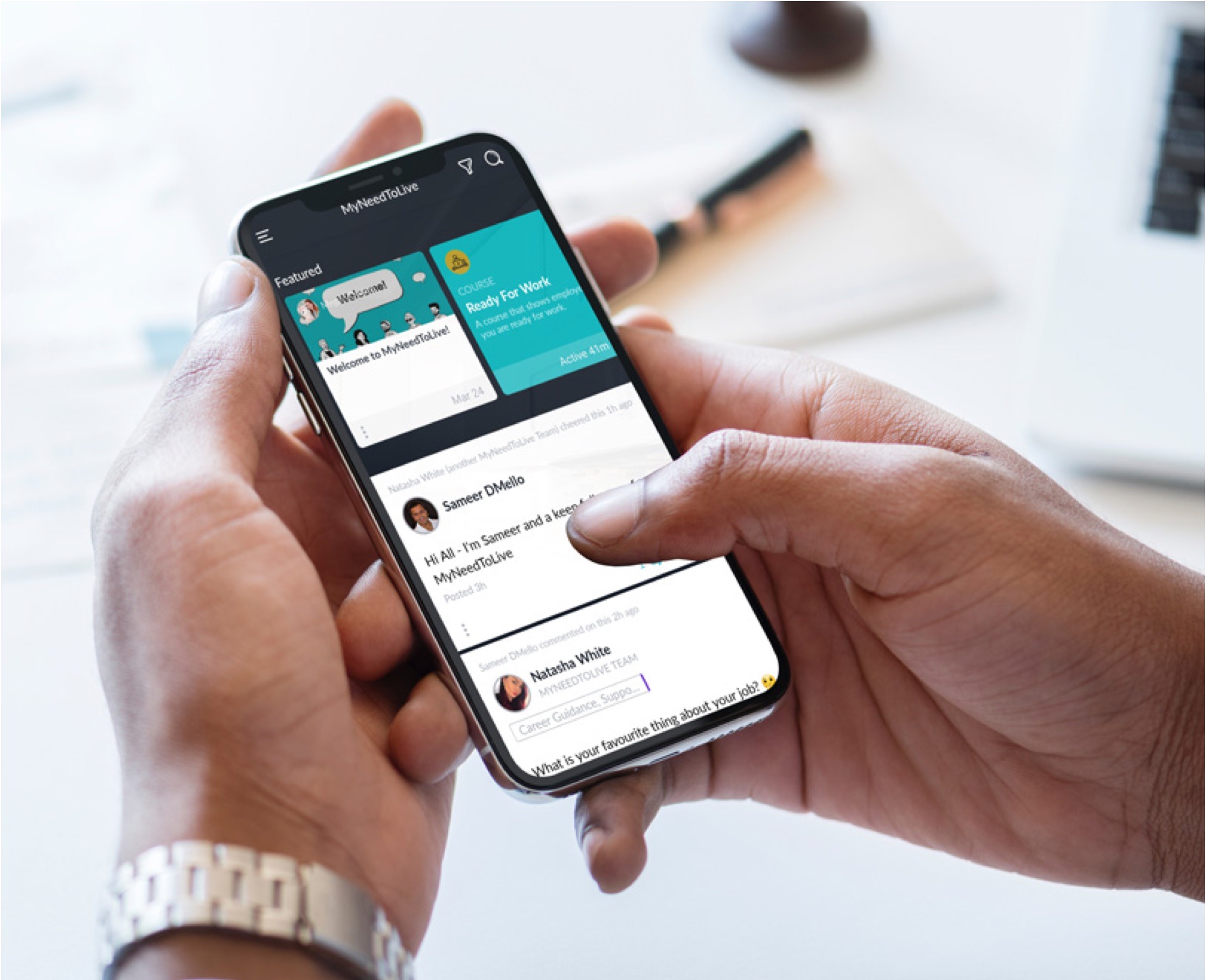

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

myntladmin