Post Brexit there is a lot of buzz over student loan repayments. Those who have just entered the job market are unsure about the best move regarding their debts.

The main cause of concern is burgeoning inflation following a lurking slump in the value of the pound after the Britain formally exits the EU. With sharp rise in interest rate, high inflation and languishing wages, the burden of debts is potentially soaring for students as well as young employees under 30.

It is a well-known fact that students in the UK graduate with the highest debt level (in the English-speaking world). Despite spending the whole year 2017/18 with the fear for elevated student loan costs, it is important to begin the 2019 with more practical and approachable resolutions.

A debt is a debt and needs to be repaid. You cannot escape the financial obligations and live indebted till 50. Likewise, it would not be wise to raise homeowner loans and repay your student debts upfront to save the cost of interest. So, what should be the ideal approach to repay student loans in 2019? Let’s find out below:

Calm Down. Set your payoff target!

Despite all these factors challenging early loan repayment decision, it is important to stay calm and focused. When the economic landscape makes a shift, it changes for all. Thus you are not the only one who is going to be affected by increasing inflation or interest rates.

You must try to focus on more productive approach such as planning for loan repayment without hurting your credit report. There is no point in crying over spilt milk. You must try to figure out when exactly you could be out of debt with your current job. It will help you stay motivated and stay attuned to your financial goals. You can make a typical 10-year loan repayment plan and calculate your monthly repayment share so as to get debt free at the end of this year.

There are two pathways to follow. You can either choose to increase your monthly installments or work for lump sum repayment to achieve the goal in the next decade:

Increase your monthly student loan payment

This approach could appear a tall order to many, especially in the beginning of their careers. However any contribution over the minimum monthly installment would help you reduce the principal amount. The interest is always accrued on the balance principal and thus you would eventually reduce the cost of your loan. There is no prepayment penalty on student loans. It is one of the convenient ways to reduce burden of student loans at ease.

Make a lump-sum student loan payment

If you do not want to take baby steps and want to see a remarkable improvement in your repayment goal, consider making lump-sum annual prepayment and sharply improve principal every year. Herein you must ask your lender to process your payment for principal only. This way you could reduce the burden of student loan more rapidly.

Another Approach: Refinance your student loans

However in case you find that your student loan is too overwhelming, you can opt for refinancing in 2019. You can save thousands of pounds in the entire term if you refinance your loan now. You can consolidate your main university loan along with other short-term loans at a lower interest rate. A lot of online loan partners assist students in the pursuit for low rate student loans. You can choose a long-term loan ranging from 5 to 20 years on fixed or variable interest rate.

All in all, setting your goals transparently can help you achieve the target with more ease. As you define the repayment plan in 2019, you can certainly enjoy debt free 2029. All the best!

Best Short Term Loans provide guidance on different type of loans. To get more information about short term student loans or homeowner loans, visit Bestshorttermloans.UK online.

Article Source: https://EzineArticles.com/expert/John_Samual/775370

Article Source: http://EzineArticles.com/9865018

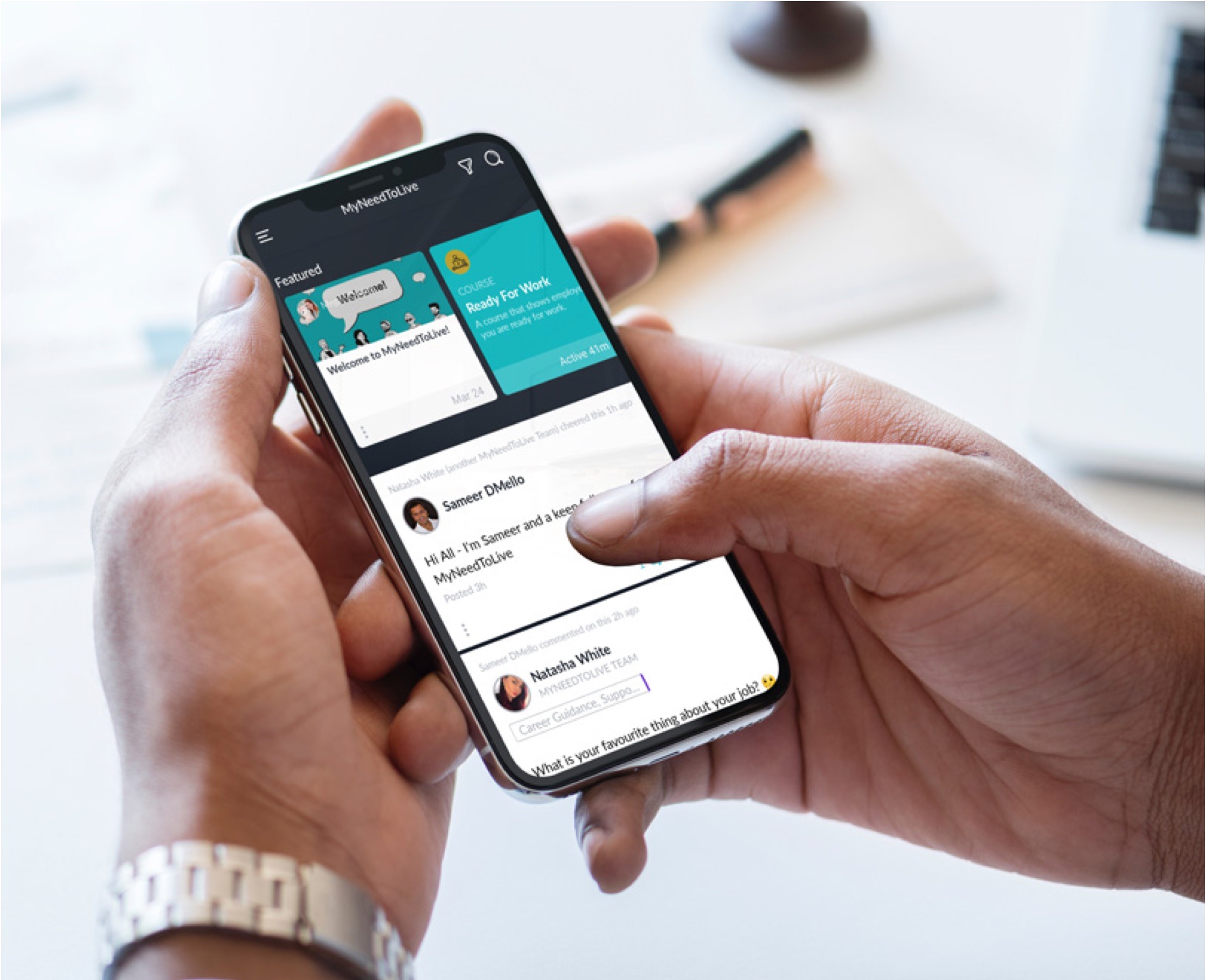

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

myntladmin