By Fahren Khalid – Verified by Big Youth Group.

As Head of Creative at the Big Youth Group, my job is to oversee the creative direction of the company and to be an advisor on anything related to strategy, special projects, advertising and marketing functions within the company.

Managing your money is one of the most important skills a young person can develop, it’s the difference between living life on your terms and living on the terms of someone else. It’s the fuel to keep the engine ticking as you move forward towards the kind of life you want. It’s important to note the majority of people don’t manage their money problem and therefore run into all kinds of problems throughout their lives; being trapped in work they don’t like to not being able to make rent which isn’t nice.

So if this is you definitely pay attention, and if your someone who’s just interested in reading up on money management these tips should help you along the way.

Everything is about perception and the way you perceive money is one of the most important steps in growing and having healthy finances. If you view money as a bad thing or something which is finite, the natural outcome of this is that you will make poor money decisions such as unwillingness to invest into new projects and ideas or simply just overspending.

Although people would say money isn’t a game you could argue that it really is. Stop making money so heavy hearted and try to view it in a brighter light. Money comes and goes and the reality of the situation is the more attached you are to money the less likely you’ll make it.

Realise that money is really a trade-off between value and a person or entity parting their cash for your value, the question is what value are you being paid for & how can you increase your value.

Investing into different projects diversifies your income stream which means your not putting all your eggs in one basket; invest in stocks, bonds, start a business, invent a product, start flipping products on eBay. The point here is you need to be in the game of value to get the reward which is money, don’t focus on how much you can make, focus on how much value you can provide.

It can do miracles in ones life, knowing that you have money spared aside gives you the confidence needed to make investment decisions, the worst that can happen is that you might have to take some emergency funds out to keep afloat.

So remember, there is no such thing as risk, failure is part of the process.

Get in the money game, hope this helped 🙂

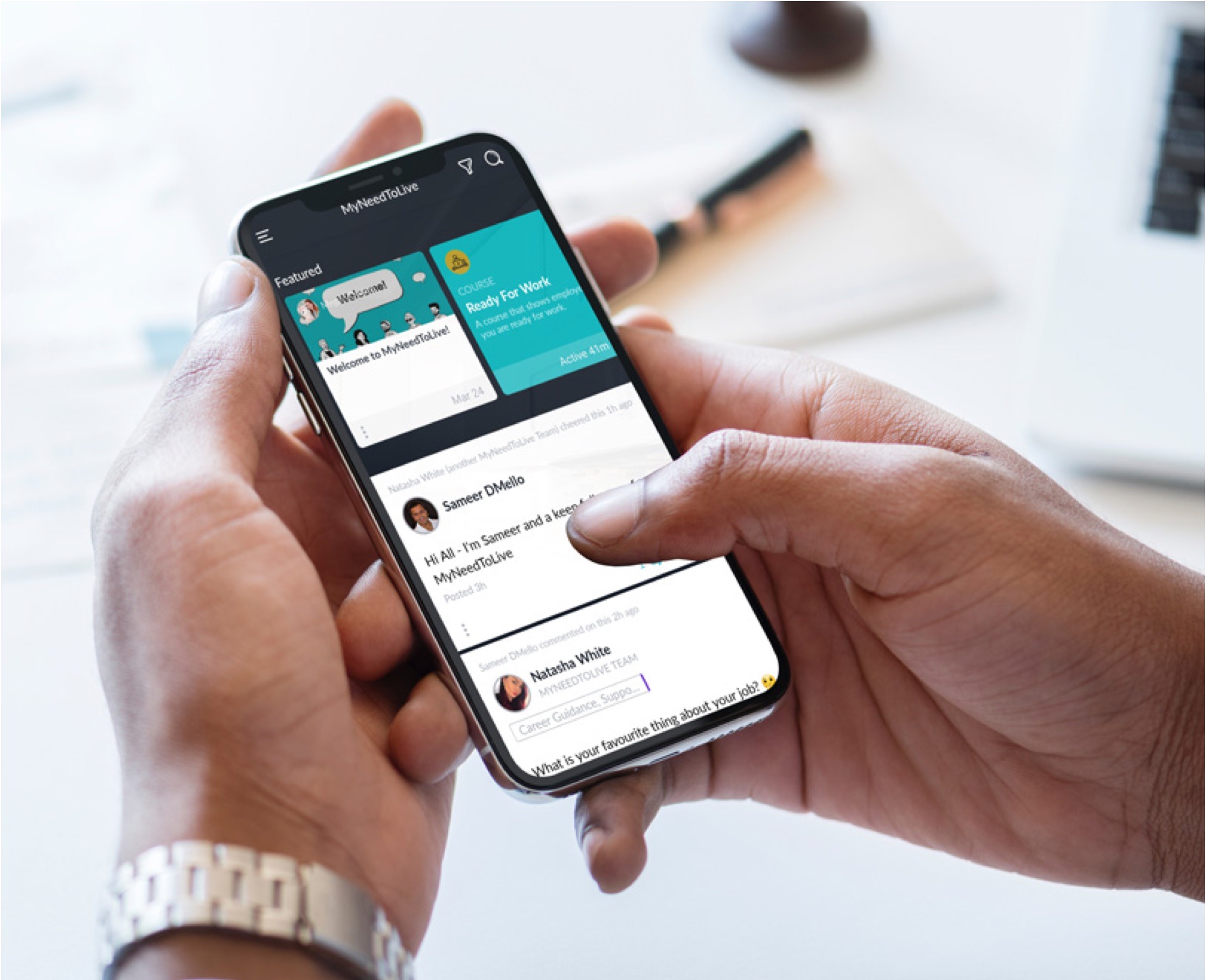

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

myntladmin