We are fortunate that our country encourages education. Education loan is available at an attractive rate and many of us tend to take this measure to pursue education. Many parents too persist that children learn under an education loan in order to inculcate a sense of responsibility in them. But I think we need to see how expensive that can get. Education loans are cumulative and the interest the accumulates at the end of the course can be a very heavy burden on a fresher who just begins work.

Further, they are more expensive than your Fixed deposit interest. So if you think you are earning some money by taking and loan and studying then you are wrong. Because you are paying more than you are earning. By you here I mean both parents and children together – one family.

Read: Choose the right car as your first car

Coming to the important part – how to start saving when you still have an education loan. First you need to understand the purpose why you need to save when you have a loan. Once you start working you are considered financially independent by the society and the family. That means, if you get a medical condition then you have to pay for yourself. These kind of emergencies need to be prepared for first before thinking of going debt free.

How to do this? Will not my debt burden be huge? Follow my simple steps for the answer:

Your company may claim to may you a CTC of a certain amount. But the amount of money that comes to your bank account at the end of the month is your ‘actual’ salary. This is the only amount which is available for you to spend during the following month. Rest could be taxes which are deducted(these will never come back to you), provident fund saving(this is a long term saving) etc.

Read: My favourite custom made baskets for all seasons

Thus the net salary that gets credited to your account needs to be considered as a base to decide your repayment towards education loan and your savings

Remember the words – Save first spend later. Ensure you save a portion towards an emergency fund. Start with the lowest risk instruments like fixed deposit or recurring deposit. As you may not have a big amount to save, recurring deposit is the best option as a fixed portion of small savings can be kept in the bank or post office which has similar features like a fixed deposit.

Start with a 1 year RD and then convert it into an FD at the end of the year.

Not used to saving first? Here practice this : 8 things to develop the habit of saving

You may observe I am speaking of paying the loan and saving even before your monthly expenses. Remember the interest that has compounded on your loan is enormous and increase your cost of the loan abundantly.

Therefore, however small the portion is start paying off your education loan. This will help you reduce your financial burden both on paper and psychologically as well.

With what remains out of the above steps make a budget to ensure you make a living. Accept the fact that this is your standard of living. Remember if you miss step 2 and do not save you will end up in more debt in case of emergencies. The situation is just not accepted.

Is budgeting every expense necessary? Read : Why should you budget every expense?

Try saving on various daily lifestyles and same every penny. The following articles will help you do so:

8 ways of reducing cost in your Home and Kitchen

Curb your tech cost just by looking around your place

Food habits that will help you be within budgets

Cut short your medical expenses with these tips

Do spend! Do not save what you have budgeted to spend. This is because under spending is also not good; for both physical health and financial health. Ensure you do it the right way!

Wishing you a successful graduation and hope you get your dream job! Let me know how you found my post down in the comments section.

Pearl Sequeira is a Chartered Accountant and a Blogger helping people to live life simple and happy with practical tips. She also runs her own blog www.pearltakes.com

Comments are closed.

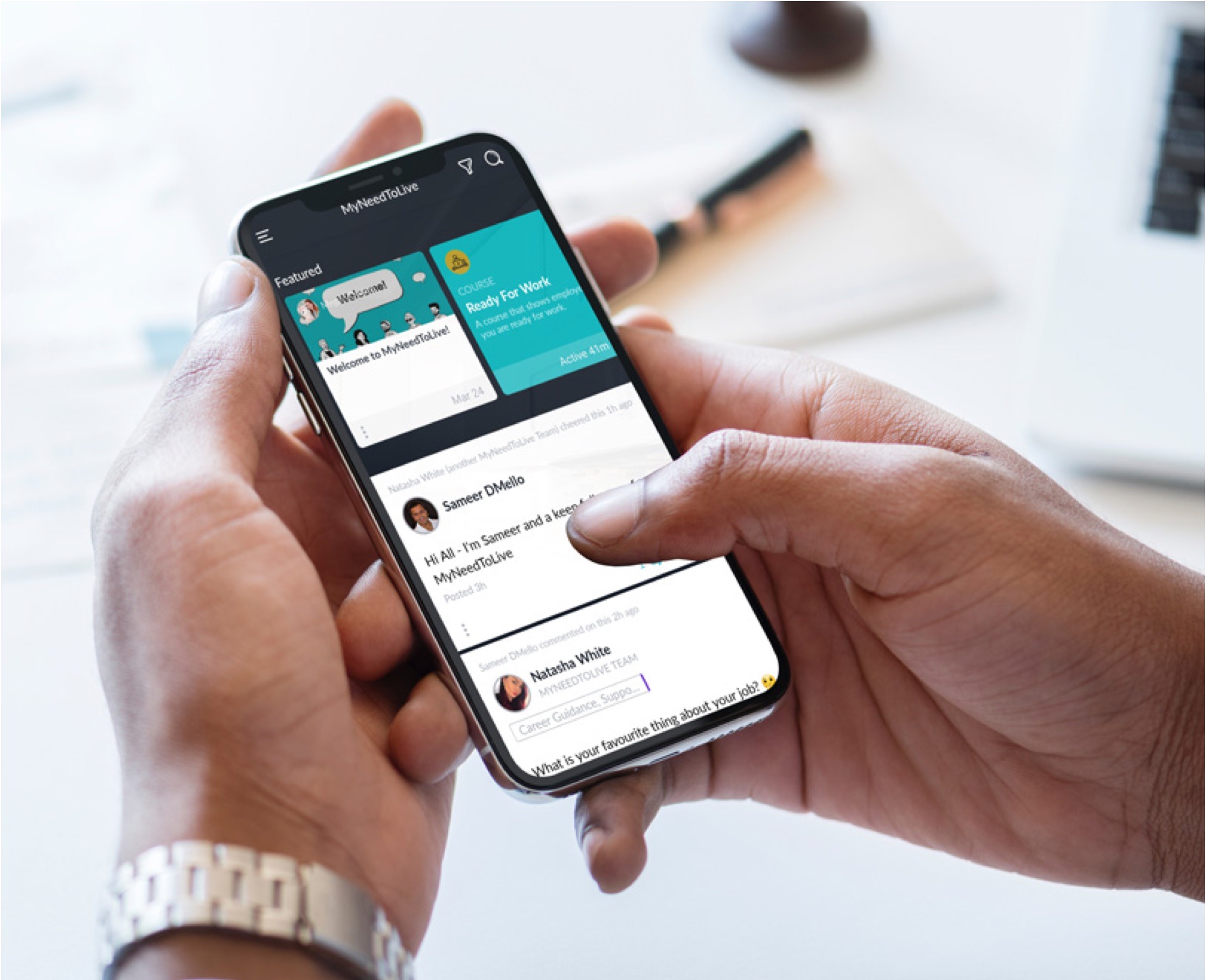

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

I love what you guys are usually up too. https://www.reiva.us