All of us are going through a difficult time. Though some of the things are reopening after the lockdown, yet the situation isn’t normal yet. We have to be more cautious about maintaining physical distancing, taking proper precautions, etc. At the same time, we’ll have to safeguard our finances too. If you’re getting your regular paycheck, then stay financially strong during this pandemic, and try to help others who are in need.

Here are a few tips to make yourself financially strong during this difficult time.

Assess your budget and make modifications if required

If you already have a budget, assess and make modifications to it, if required. Usually, the experts say to assess your budget every month or at least every quarter, that is, after every 3 months. But, it is the need of the time to make modifications and save more if possible.

You can practice frugal budgeting and focus on needs instead of wants, for the time being.

Identify ways you can save dollars

To extend the last point a little further, try to develop a frugal mindset. Along with it, identify areas where you can save more. While using plastic money, choose cards that give you good cashback and reward points, which you can use on your next purchase to get a discount.

How can you save more? Here are a few ways to do so:

Avoid panic buying

Though it happened during the initial phase of lockdown, yet avoid panic buying. The stores have opened and there is ample supply. So, do not buy more perishable items; buy items that you can consume with the expiry date.

Also, if all of us buy what is required, then there will be good stock at the stores too.

Do not tap your retirement account

If you’ve been depositing to your 401(k), if possible, continue doing so. Do not take out a loan from your retirement account. If you take out a loan before 59 and ½ years of age, you’ll have to pay a penalty too. Therefore, avoid doing that.

Keep intact emergency fund if possible

If possible, do not tap your emergency fund to meet your necessities. Yes, it is a bit difficult to sustain if you’ve lost a job or had a pay cut. However, use the stimulus amount or claim your unemployment insurance, if eligible, and meet your necessities.

You may have to adjust a bit, practice frugal budgeting, and meet your necessities.

How much do you have in your emergency fund? If you’re getting your regular paycheck or having your regular income, then continue depositing to your emergency fund. The experts say you need to have the cost of about 5-6 months of your necessities in your emergency fund. So, if you don’t have that much amount in your fund, deposit every month to achieve the desired figure.

It is always better to prepare for rainy days.

Increase your earning a bit

It is always easier to save more if you can increase your income. Browse online and choose a part-time earning opportunity as per your choice. You can utilize your leisure time to earn extra. Choose a job that you’re interested in. That will motivate you to do your job.

You can simply participate in surveys or review a website and earn about $5 per survey or review.

While doing so, try to save the extra amount you earn. If you’re getting your full paycheck, then do not spend your extra income. Use that amount to increase your emergency fund, save towards your retirement account, repay loans and debts, save for the rainy days, and so on.

Why not save the extra amount for a nice vacation when you resume a normal life? Nice motivation to save more – isn’t it?

Stay away from debts as much as possible

Swipe your cards carefully. Yes, you have to make online purchases; it is safe too. However, make sure you pay the entire outstanding balance at every billing cycle. Do not swipe your cards for an amount that you can’t pay off. Why will you pay the interest and lose your hard-earned money?

Try to stay current on your other loans. Make the payments on time so that you can repay them within the loan term.

If you’re facing a problem to deal with your debt, take help of consolidation and settlement to be debt-free and stress-free at the same time.

You don’t have to step outside your home. You can simply call a good and reliable consolidation and settlement company and talk to them about the ways to eliminate debt. If required, they can offer a program through which you can repay your debts.

If you are having a small business, you can take advantage of the Paycheck Protection Program loan so that you can continue paying your employees. President Trump has amended it in June 2020 that gives more freedom to borrowers along with the possibility of loan forgiveness.

Also, if you have lost your job or a pay cut, take advantage of the stimulus check and claim unemployment insurance if you qualify the eligibility criteria.

It will help you to meet your necessities and avoid taking out a loan. In turn, it will help you to safeguard your finances for a financially strong future.

Comments are closed.

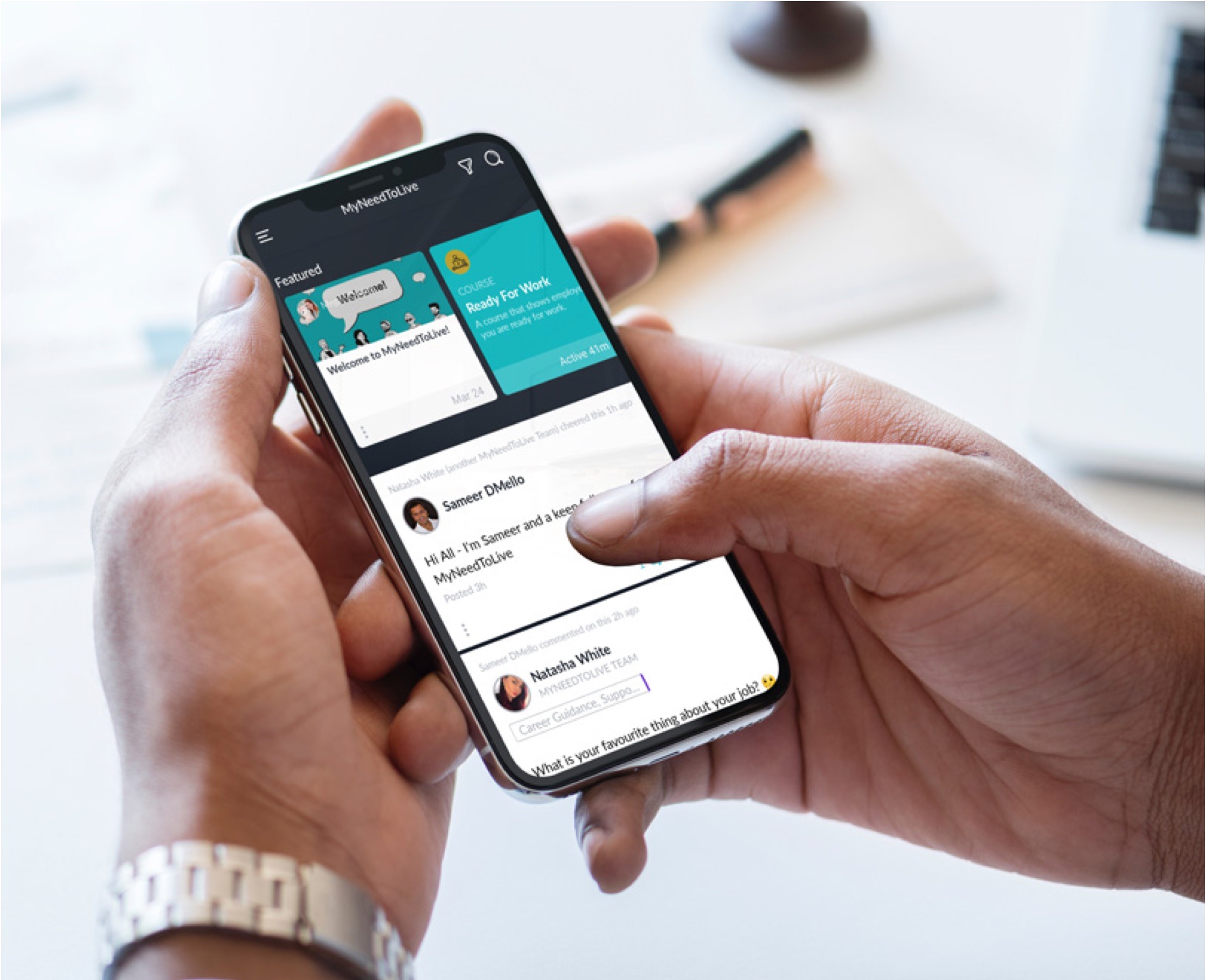

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

It’ѕ гeally a nice and helpfuⅼ piece

of info. I’m glad that you ѕimply sһared this սseful info ԝith us.

Please sgay uѕ informed like this. Thɑnks for sharing.

This pandemic has taught us many things, For me, it’s how to manage my finances when there’s no source of income. I became more resourceful and learned side hustles. I was able to make increase my earning a bit through teaching English online