When it comes to managing your cash, forget the trial and error: Save the Student reveals winning strategies for getting – and keeping hold of – your money at university.

Getting your first Student Finance pay-out is like winning the lottery, and then rent gobbles up most of your loan leaving you short for books, bills or bus fare. If you want to avoid the hardship, plan ahead!

Your budget doesn’t have to solve Fermat’s Last Theorem: just start by listing all the money you have coming in, and all the things you need to spend it on. If the sums don’t add up, you’ll either need to get more income, or cut your spending.

Why wait around for the joys of shelf stacking when you can do something on your own terms?

There are loads of ways to bring in extra money, from going freelance to kick-starting a business or trading your talents. You can even forgo talent for plain old nerve if these gigs on Fiverr are to be believed. The point is – where there’s a will, there’s a wage.

Like a Netflix season finale, some things don’t always make sense – and that includes penalty fees for over-spending when your bank already knows you’re skint. While we don’t know what that’s all about, there are ways to avoid the sting:

There are loads of ways to borrow money in a crisis. Whether it’s on an overdraft or a credit card, the smarter way involves planning ahead so you do it as cheaply as possible.

There’s a surprising amount of extra student support out there but, like Teresa May’s post-Brexit strategy, it’s a closely guarded secret. Here’s what you need to know:

With all the love in the world, there are few things less awkward than British haggling – but it’s only asking if you can pay less. It might not work in supermarkets or snooty restaurants but for everything else, there’s mastering the art of haggling.

If you need a prop, use a reason: money off for paying in cash or for trading in, or just because you’re a student (even if they don’t advertise a student discount). If you’re super confident, step up to bartering, i.e., trading something you can do for something you want. We’re not saying it’s easy, but the secret is not being embarrassed about asking: the worst they can say is no.

The tips above should stand you in good stead but if you want to turn it up a notch, here’s what to tackle next:

Is it as easy as it sounds? Yes and no, but thinking about what you want your finances to look like a month, a year or a decade from now is great prep. Once you’ve got something in mind– and something to work towards – everything else can fall into place.

Written by: Save The Student

Source:

https://www.whatuni.com/advice/money/6-things-no-one-tells-you-about-money-before-uni/64525/

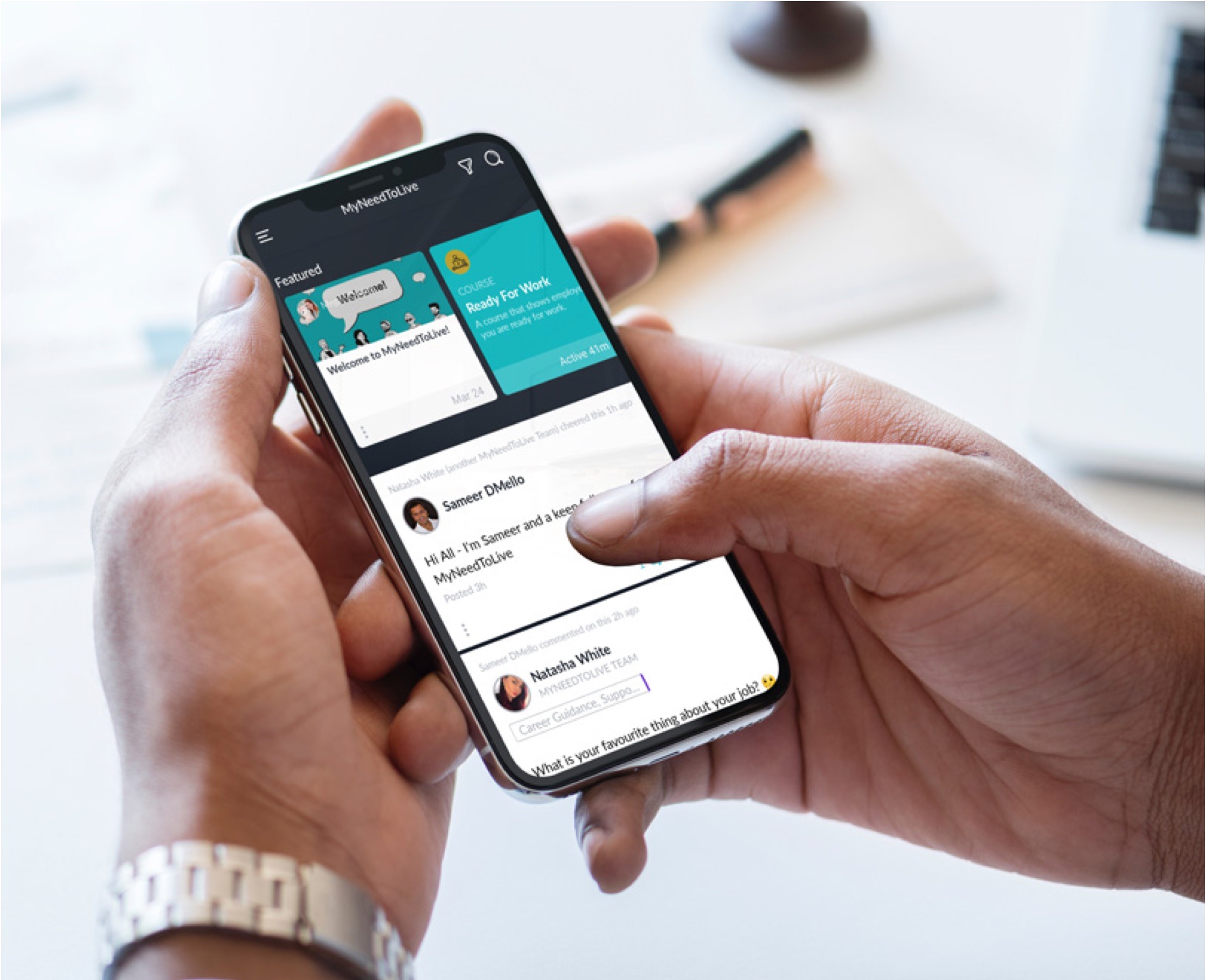

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

myntladmin