When it comes to money, everyone seems to have an opinion or else be seeking a magic “get rich quick” solution. Unfortunately, we can’t all win the lottery nor can we expect to just create wealth by wishing for it. We can, however, get informed, learn our options, and efficiently invest and manage our money as best as possible.

While there is certainly no shortage of financial information being made available through the internet these days, it is still important to do your homework so as to truly separate fact from fiction. Below, we’ve listed the most common financial myths you need to ignore effective immediately.

This is so, SO far from accurate! While having more money to invest initially certainly can increase your earning potential, the truth of the matter is that investing even a little bit of money can go a long way. The key is to just get started and take advantage of the benefits of compound interest for as long as you can.

Given the sheer amount of debt in this country (approximately now $13.29 trillion – YIKES!), it makes complete sense how debt gets a bad reputation.

However, not all debt is bad. Sure, high interest debt such as credit card or consumer debt is a net negative on your financial situation, but other debt that further propels your earning potential or marketability can be positive debt.

Consider certain student loans, for example. Most students attend college (and therefore accrue debt as a result) because they believe receiving an advanced degree will increase their chances of obtaining a job that allows financial freedom and flexibility. In this instance, the expense of obtaining a college degree is seen as an investment in greater earning potential and increased financial security as a result. Other debt that may prove beneficial? A home equity loan or other type of financing that allows a homeowner to make significant improvements to their home in order to boost the amount of equity.

While for many, the bank is the most likely choice for stashing your hard-earned pennies, the fact of the matter is that this money won’t increase in value quite enough to sustain your lifestyle long-term. Yes, the bank may appear as the most obvious choice for safe-keeping, but this money will only generate a relatively negligible amount of interest over time. If you really want to keep pace with inflation and accumulate wealth, you’ll need to consider investing (albeit, strategically and thoughtfully).

Repeat after me: no, no, no, no, and no. Credit card debt is often the most difficult debt to resolve thanks to sky high variable interest rates. This is why most financial experts recommend you save at least 3 to 6 months of your income in a separate Emergency Fund to be used only if the worst should happen. While it definitely can be far more fun to spend your money on lavish trips and fun toys, keep in mind that those things won’t be of much help to you should you need to quickly come into cash if you fall on hard times or experience a difficult life challenge. Using a credit card for emergency expenses may seem like a no-brainer, but believe me, the interest you will accrue on that balance likely stick around much longer than you care to experience.

Yes, you technically can… but let me ask you – what are you waiting for? A better, high-paying job? For life to slow down? For the kids to get a bit older? To get married first?

The truth is, there will ALWAYS be a better, more convenient time to get started if you keep waiting. If you constantly find yourself making excuses as to when or how you’ll start really prioritizing those finances, then consider this the sign you didn’t know you needed. Take a deep breath and set aside some time this week to take the first step. You’ll be so glad you did.

Author: Brittan Leiser

Brittan Leiser is a Financial Advisor in Cleveland, Ohio. Brittan created AdvisHER after recognizing that in the male dominated financial industry, women often felt ignored or overwhelmed when it came to having a conversation about their own personal finances. A graduate of the University of Notre Dame’s Mendoza College of Business, Brittan is passionate about helping clients understand their financial options in order to achieve their true potential.

Comments are closed.

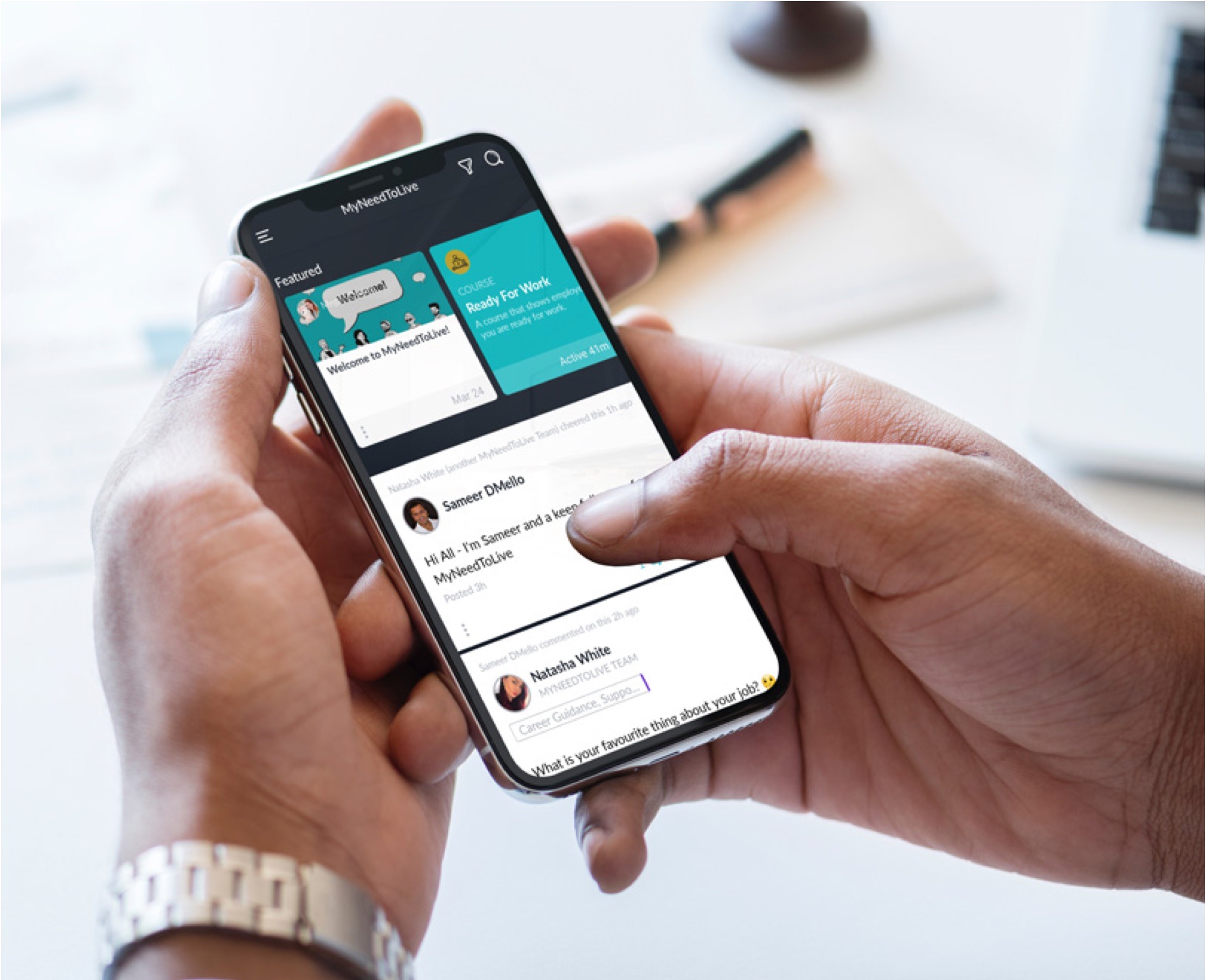

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

I’d love to read a guide of yours on investing! Never thought about this beforehand!