Hands down, I’m quite a bit on the conservative side when it comes to spending money (except when it comes to candles ????). I was raised to be a saver and I’ve lived my life that way. As I’ve gotten older, I’ve reaped the benefits of being a saver. Having a nice emergency nest egg has been quite a comfort. It does come with some challenges though, especially early on as a student.

Admittedly, it’s very hard to be a saver when you are already on a tight budget. As a saver to the core, I had to learn to acknowledge that you can’t always be a saver. Sometimes you just need to be a survivor. With University costs and living expenses there often is little discretionary funds. And let’s face it, saving it all would make for a pretty dull life. For me, in times like this, taking my meager discretionary funds and spending it on self-care and fun was money well spent.

Saving for me started when I had enough money for University, some fun and self-care, and then just a bit left over. Starting a savings account and just depositing a few pounds/dollars a week or month into it may sound like it’s not worth it, but it actually is. It adds up over time. For example, just a few pounds (or dollars) every two weeks adds up to quite a bit over the course of a year. While it may not buy you a car, when you are in University that can be just what you need to help you through an unexpected expense. Or, it can be just the start of a bigger account.

Life as a student is full of unexpected expenses. Oftentimes there’s a car repair you don’t expect, a larger book bill then anticipated, or a medical bill that pops up. Expect your hard-earned savings account to fluctuate during this time. It’s great to start one with the goal of continually building it up over time but know that it’s likely to fluctuate. Life as a student is full of changes and evolving life situations. Your savings account is likely to experience much the same fluctuations. What’s important is that you’ve started a savings account and are dedicated to building it, when possible.

Weekly or monthly deposits may not always be possible. What’s important to building your savings account is that you keep it in focus, even if you can’t build upon it. And know too that even super small deposits count. It all adds up! A nice-sized savings account at the end of the year when in University is definitely sometime to be proud of. Understand that it’s not always possible, but my experience has taught me that even the smallest of efforts helps. As my father would say when it comes to things like this, “keep an eye on the ball.”

Have you opened a savings account? How is it going? What strategies have you found to build up your balance? Are you glad you opened an account?

Click here to find out how you can become a MyNeedToLive Everyday Role Model

Comments are closed.

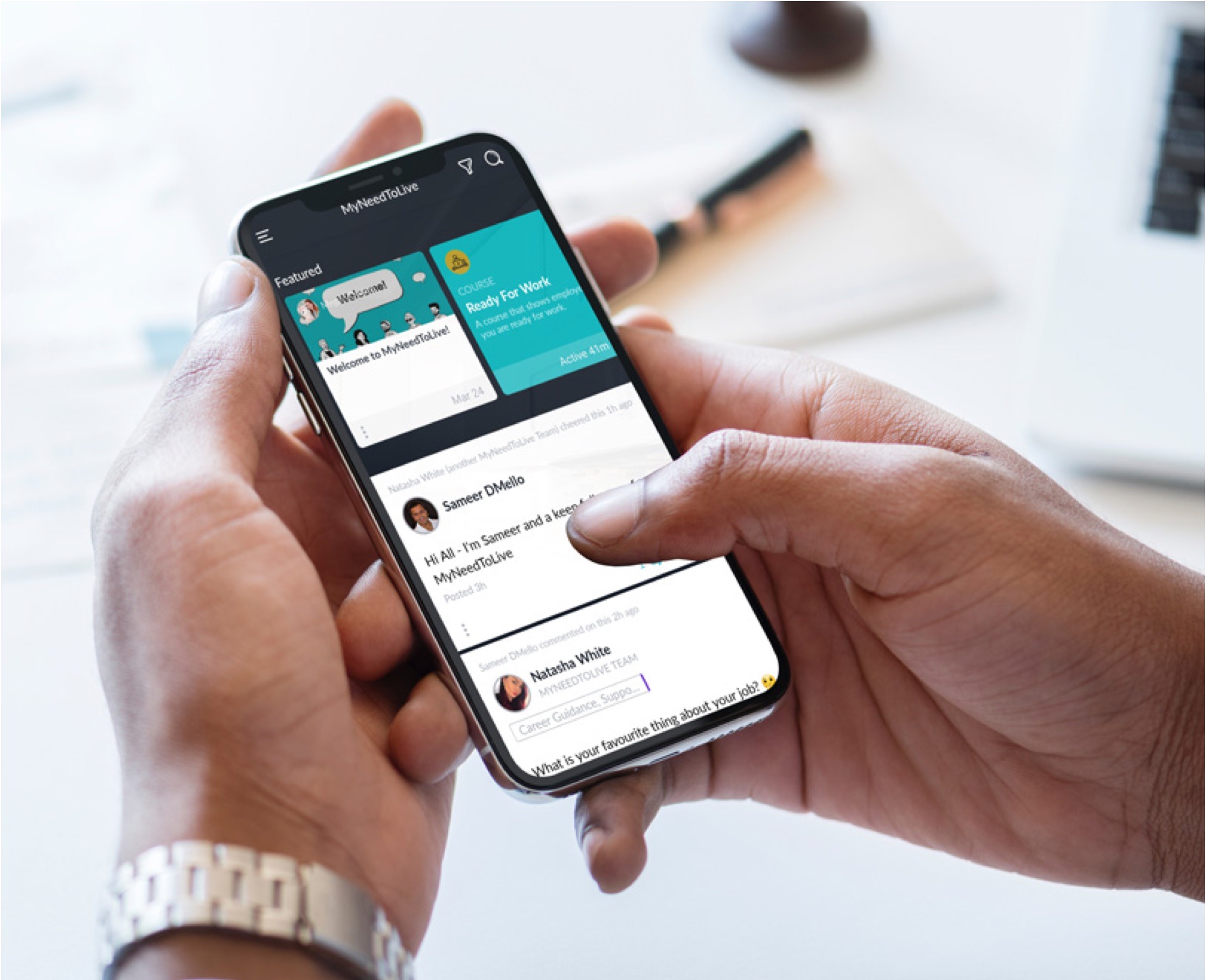

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

Amen on the candles sis! I find a good saving strategy is taking cash along on small less than $20 errands and throwing the change in a jar after. This usually adds up to about $800 a year in effortless saving for me.

A change jar is a great idea Dolled Up! It’s amazing how quickly that money can add up!

It is so important that all of us learn how to budget appropriately. It can be hard as a student because there are so many expenses. The biggest thing is to expect the unexpected – this is where the savings kick in really nicely. As a student, I learned to live within my means. Thanks for sharing!

Nancy ♥ exquisitely.me

Thank you for commenting Nancy – glad you enjoyed the article! Thanks for stopping by!

I’m not too bad at saving but I have to admit that I didn’t even bother trying when I was at uni. I did get my student loan paid into a separate account to budget that throughout the year rather than dipping into my other money x

Sophie

It sounds like you budgeted very well though Sophie! Congratulations – it’s tough to do while in University!

Short, simple, and effective. I like the Expect the Unexpected portion. Knowing is half the battle.

I’m glad you enjoyed the article Jamilyn – thanks for stopping by and sharing your comment! 🙂

I am bad at saving, I just spend the money as it comes as self care is important to me. I didn’t save as much while at Uni but as I started to grow older, I understood its important. Every single time I go to a store, it takes a lot of will power to not end up buying something I wouldn’t need. Thank you for sharing this post. I will always keep saving in mind. It is vital to always expect the unexpected

You are very welcome Rayo – thank you for sharing your real-life experiences! You are not alone in that!

I think that this is excellent advice for more than just students. Expecting the unexpected is huge. The advice I would add to this is to save half of any additional money that comes in (like tax returns or gifts), especially if it’s unexpected (money that you didn’t already include in your budget) to build up an emergency fund.

Excellent advice Robyn – thank you for sharing!! Great idea!

Really helpful tips especially for students struggling because they can’t meet their expenses. Thanks for sharing.

You’re welcome John – glad you enjoyed the article!

This is great. I definitely did not understand the importance of budgeting when I was a student. I still have the student loans to prove it.

You are definitely not alone Adriane – it can be very hard to do, esp. with the cost of Uni these days!

I am not a student but I need to advice anyway due to lack of Jobs during this corona crisis. So thank you so much!

You are very welcome Ann – yes, this advice definitely translates to today’s situation to all of us!

It’s definitely harder to save up when the expenses are higher! A few years ago I went back to school again, which took some adjusting as I found myself working with a student budget once again – something that I haven’t done for a few years now. That being said, since I’ve graduated my budgeting is better than ever… I found that I carried over some of those habits even though I have more money coming in once again.

That is fabulous Britt – congratulations! And congratulations on your graduation!