Studying in a global university is an uphill task. With increasing admissions and other expenses, parents cannot guarantee the finance for their child’s higher education. Securing admission under this scenario requires money and time management too. The range of expenses include admission costs, hostel rent books and the tuition fee. Parents dream of a successful career, and therefore, nothing should come in way of pursuing the studies. Parents help to a great extent money wise, but even they have their limits. In this situation, students are offered an opportunity to take care of their expenses in the form of short term student loans. Availing the loan is fairly simple. A loan benefits by providing the funds to take care of their cost of education.

Advantage of the Student Loan

The loan is important to anyone looking forward to secure finance for their higher education. The acquired funds have capability of helping the students for further education. There are a few advantages to these loans listed here that will help the borrower make a sensible decision:

• Minimal Interest Rates

Before applying for any type of loan, people are cautious about the interest rates. Nobody wants to burden themselves with whopping interest rates that would result in non-repayment of the loan amount. Student loans are suggested by many brokers on competitive APRs and manageable terms of repayment. The borrowers have an option to consider all the available offers through a comprehensive online research and compare the prices. Only after proper research, the customer should approach the regulated broker.

• Flexible terms of repayment

Before countersigning the documents, applicant must clearly understand the terms and conditions that are being laid down. The intermediary will explain them to the borrower, if he is unable to understand. The repayment provisions are kept trouble-free. The payment amount is decided keeping in view the financial condition of the applicant. Sufficient time is provided to repay the borrowed money. Paying off the loan is reflected on the credit report, finally improving the credit score and establishing the credibility.

• No requirement of guarantor

When the individual applies for the loans online, there is no need to provide the guarantor. Adviser makes sure, the lender disburse the funds without putting forth the condition of arranging the guarantor. This saves a lot of time, as you do not need to search for the person, to act as your guarantor and support your application.

Student loans not only serve the purpose of providing quick funds for the education. These types of loans also assist in creating a positive credit history. The funds are not provided out for free. The short term student loans must be repaid when the borrower completes his or her education. Adequate time is provided for the payback.

BestShortTermLoans is an online broking company willing to guide the students to manage their expenses. Special deals on short term student loans are arranged to provide sufficient funds to make the expenses related to education.

Article Source: https://EzineArticles.com/expert/Maria_Smith/2349895

Article Source: http://EzineArticles.com/9633636

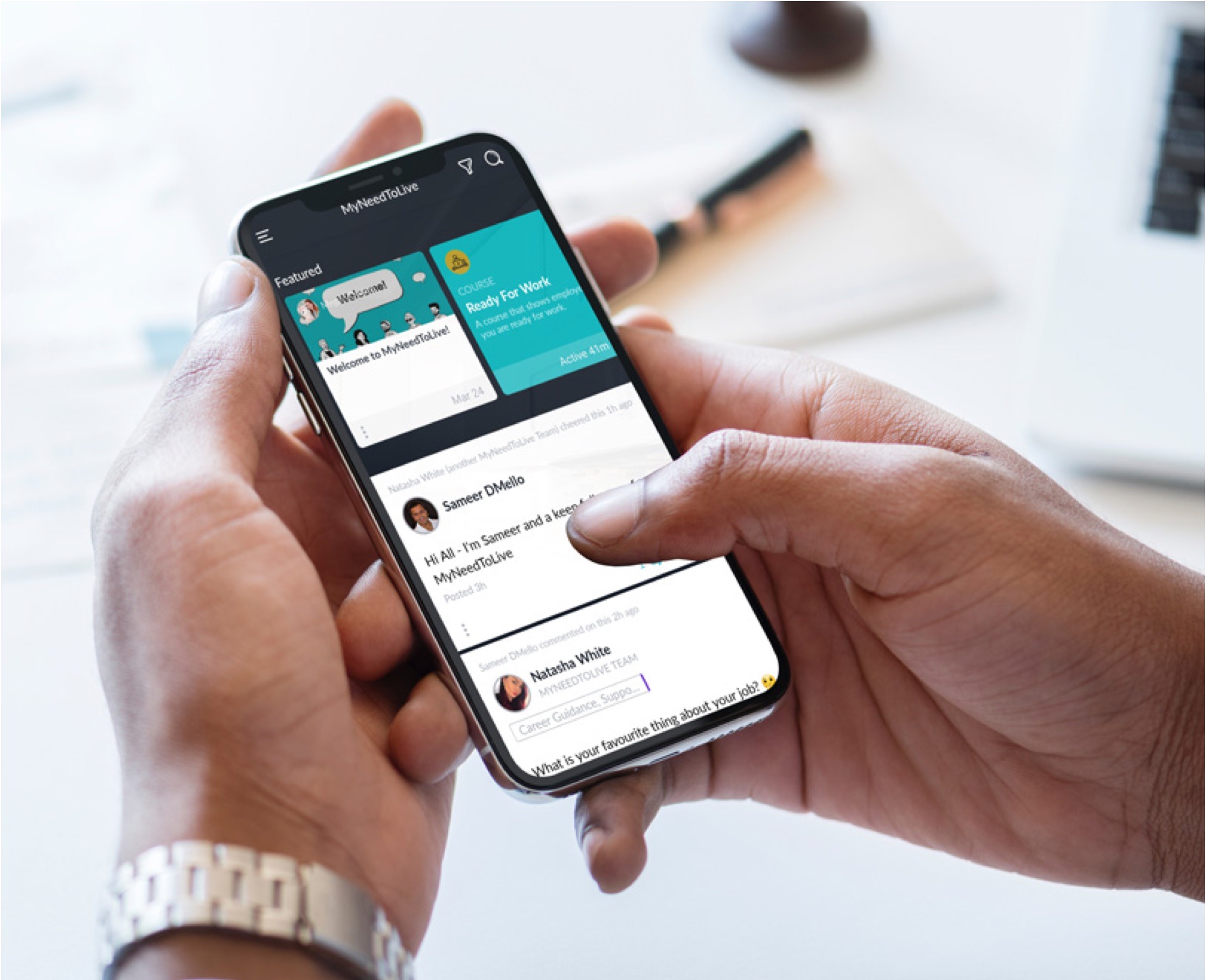

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

myntladmin