So, the year is wrapped up and we move to the next one with new resolutions, so much positivity and all that excitement to catch up with the peers again!

But this time, let’s make it a bit different. Let’s not do the rookie mistakes with the money, let’s not spend everything on parties, shopping and those cool things to be a part of the “cool” groups. This time, let’s focus on growing – you and your money.

Here are the steps to get started –

Before starting a routine, it’s important to understand where you currently are. Assess yourself and see what are your current sources of income and what can be the prospective options. Then, check your bank statements and your spending habits. Just list down the categories you spend on – food, fuel, utilities, shopping, etc. And the important thing is to set yourself a goal. Where do you want to see yourself in two years and then break that goal down into small short term goals.

Remember how, as a kid, you used to keep that secret diary which hid all those things that you wanted to share only with yourself?

Just bring that habit back in life and see how life changes. Bullet Journalling is a creative way to self care and keep your priorities in check. Keeping a finance bullet journal, (I like to call it – FiBuJo) helps you stay on track with your money.

At the end of each day, just pen down all the expenses you incurred during the day and tick the categories which they are a part of – necessities, important expenses and leisure. You’ll be more conscious of your pennies and would enjoy seeking frugal ideas.

If you save around £10 everyday, you’ll have around £300 at the end of the month and £3600 at the end of the year. Imagine what all you can do with that!

I will keep repeating that unless you make it a part of your life! 😉

Once you get into the habit of journalling, you’ll immediately notice at the end of each week/month, as to which category is putting pressure on your wallet. You’ll be able to see whether it’s the food or the drinks or cabs or eating out or the crazy weekend parties.

Now that you can see clearly, where you spent your money, keep a budget for every category and decide how much do you want to save every month. Stick to it!

Create rewards for yourself for sticking to the budget. For example, everytime I am able to stick to my groceries budget for the month, I reward myself for an extra €20 for my grooming session or something else.

Everyone needs a little money of their own which they want to spend wherever they want to, otherwise life gets boring. After all, life is short and we need to have fun!

Saying that, make sure you budget for some fun money for yourself for the month, but do not get overboard. It is ideal to keep aside 7-10% of your income for self care. Because self-care is the important buddy! It gets you all the positivity and the good energy that keeps you going through the life.

While you’re in your early years of student life, you do not have a lot of responsibilities and can manage to save some money. While you’re at it, think about investing and take th first step.

It’s normally said that most of the wealth creation starts when you start investing in th early years of your life.

Also, the power of compounding is great. A single penny invested today can reap millions 10-15 years later. So think about your investing options and start creating your wealth today.

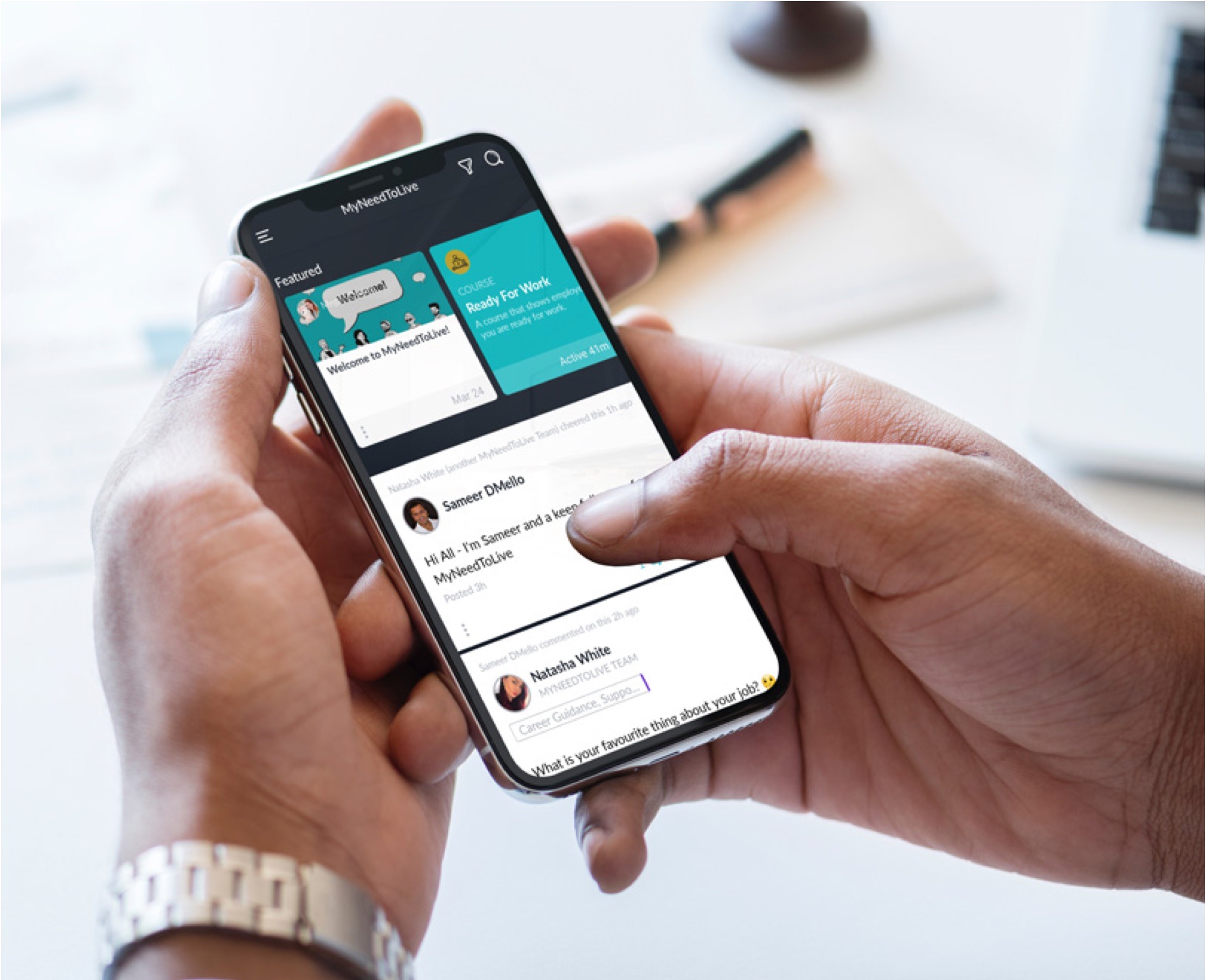

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

Rashmi Kathuria