Getting organised with your bills, recording your in-goings and out-goings is essential, especially for those people who tend to overspend each month. Write a list of all your bills. This would be rent, utility bills, entertainment bills, gym memberships, subscriptions, food allowances. Record the dates in which they are being paid from your account. If possible, change all your payments to be taken from you’re account at the same time, so you have a clear idea of how much ‘free’ money you have remaining.

Sometimes we end up paying out on things we really don’t need. For example, mobile phones. As a student on a budget, you really don’t need a high-end phone that’s all ‘singing and dancing’ when you only use it for social media, calls and texts. Pop down to your local Carphone Warehouse or online and get yourself a mid-range phone contract or a decent sim only deal. The drop for a £40+ monthly phone contract to a £20-£25 monthly contract can go a long way.

Look at your banking and see what you usually pay out for. Write them all down and think to yourself, do I need this? or can I get it cheaper? If it’s unneeded then treat yourself to it occasionally, instead of regularly. If you think you can get it cheaper then change your provider and get it cheaper! Save money!

Download your online banking app and sign up. You can then easily track your ingoing’s and outgoings as well as transfer money, apply for student overdrafts and effectively manage your money with ease.

One of the biggest shocks when you become a student is realising how much things cost. It sounds silly but the shock you have when you realise how much cheese or Weetabix costs is immense. You don’t need to buy branded all the time. I can tell you Lidl’s version of Weetabix tastes just like it, for a fraction of the price! Another option is to get a shared shop. This can be tricky because it can sometimes lead to arguments of whose food is whose. But by a collective group of people sharing the price of necessities as such as bread, milk, loo rolls etc it can cut costs for all.

One thing I personally found saved myself a lot of money was collectively contributing to buy a MuscleFoods bundle (Roughly £59-£70 which contains around 72 meals worth of meat). We divided the meats between us once it was delivered and had a meal each week together. Each bundle lasted around a month or a month and a half, supplied us all with high quality meats at a fraction of the price. MuscleFood deals can be found on NeedToLive.

For those foods, treats or events that you can’t go without, Look for discounts! NeedToLive offer amazing discounts without the need of creating an account! Get your shopping with Iceland at a fraction of the price, treat yourself to Papa Johns with special discounts or buy new clothes from your favourite brands with exclusive deals though NeedToLive. Look online, find your discounts and save money! Becoming thrifty and frugal isn’t a bad thing, it saves you money which you can use on other things!

This is the option that a lot of students must fall back on, which can be a struggle. Juggling a part time job with studies can be stressful but it does bring in that extra income which, most of the time, is needed. I would recommend finding a job where you work between 4-16 hours and no more than that. You need to find time to study as well as have a social life. A frequent reason why student become over stressed is due to not being able to find that Work/Life/Study balance. So, popping around the local area with a C.V or applying for roles on indeed.com can be beneficial, preferably before uni starts as that’s when most businesses will have vacancies.

Freelancing is another fab option to get that extra income you need. You don’t need to be creative in any way to freelance your skills. You can offer tutoring (NeedToLive have a platform for tutors if you would like to sign up), you can offer editing on essays (I for one am terrible at grammar and spelling), you can become a blogger, become a mystery shopper, sell home made crafts on NeedToLive or Etsy, become a Virtual Assistant (Help manage social media accounts, emails etc from home) and so much more! All this can be done in your free time and gives you an extra source of income to help your studies.

This was a huge one for me during my studies. Competitions and Freebies. I won a lot of free stuff by simply taking part in competitions. Gift cards, stationary, memberships etc! It all helped me during my studies. So, get looking online for competitions, look for local competitions, message people and ask if they would like you to review products! Competitions and reviews help promote businesses so you’ll both be helping them out by spreading the word about their business and you get free stuff! Win Win!

Learning how to survive on student budgets can be difficult, but if you organise yourself, know your in goings and out goings and budget then you can find your money difficulties disappear.

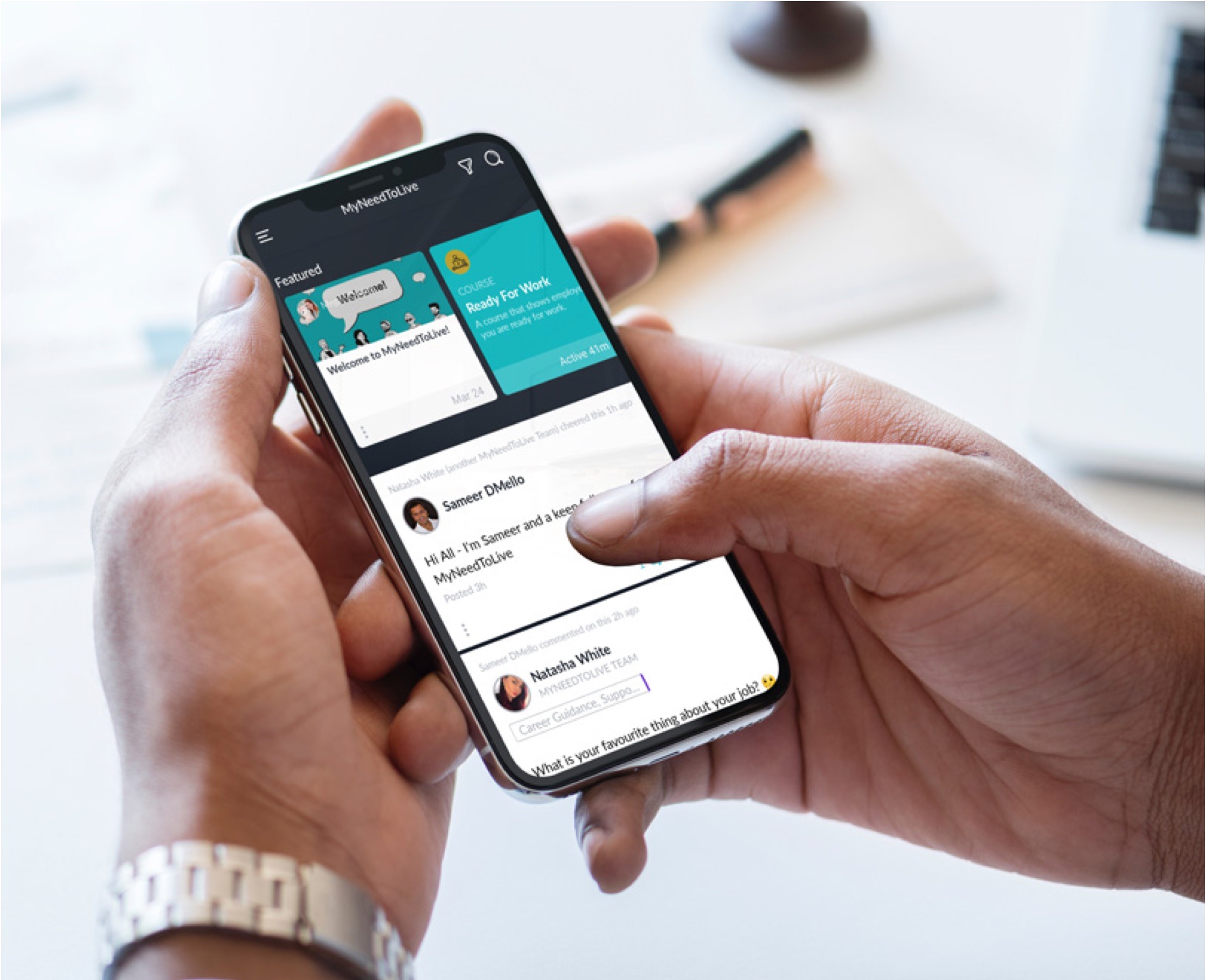

Whether you want to grow your skills, get picked up by an employer who needs your specific knowledge, earn more qualifications for your CV, or some combination of the three, the My Need to Live community is here to support you.

Join the platform 01 March 2023

01 March 2023

30 October 2022

30 October 2022

The My Need to Live Support Directory is a resource created by us to help 16 – 24 year olds find the help, support, organisation or practitioner you need to help them with their wellbeing when they need it.

Support directory

myntladmin